Understanding Calendar Yr Deductibles: A Complete Information

Associated Articles: Understanding Calendar Yr Deductibles: A Complete Information

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Understanding Calendar Yr Deductibles: A Complete Information. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Understanding Calendar Yr Deductibles: A Complete Information

The world of insurance coverage might be complicated, with a plethora of phrases and circumstances typically leaving policyholders feeling overwhelmed. One such time period that steadily arises is "calendar yr deductible." Understanding this idea is essential for successfully managing your insurance coverage prices and guaranteeing you are adequately protected. This text offers a complete clarification of calendar yr deductibles, exploring their implications, comparisons with different deductible varieties, and sensible recommendation for navigating this side of insurance coverage protection.

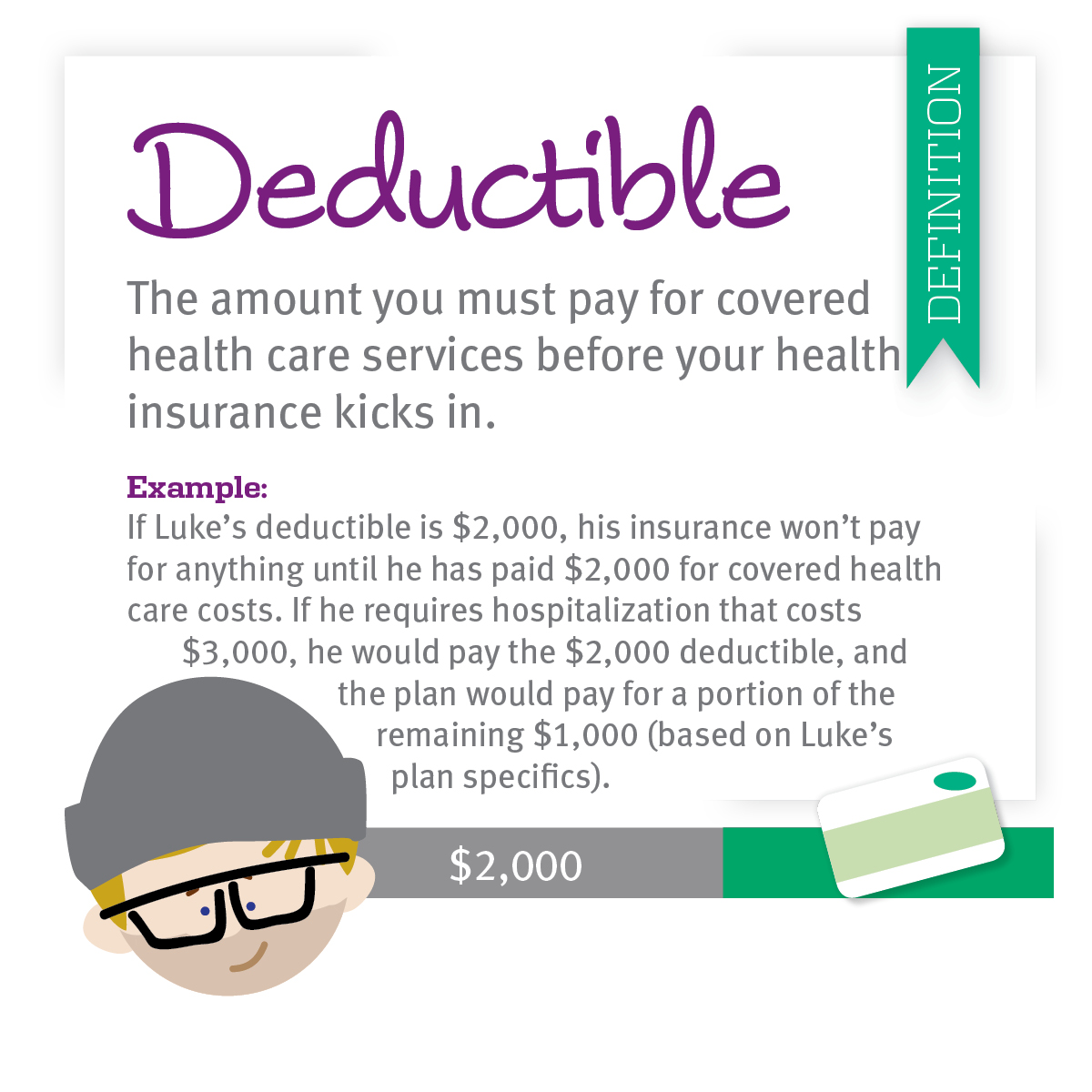

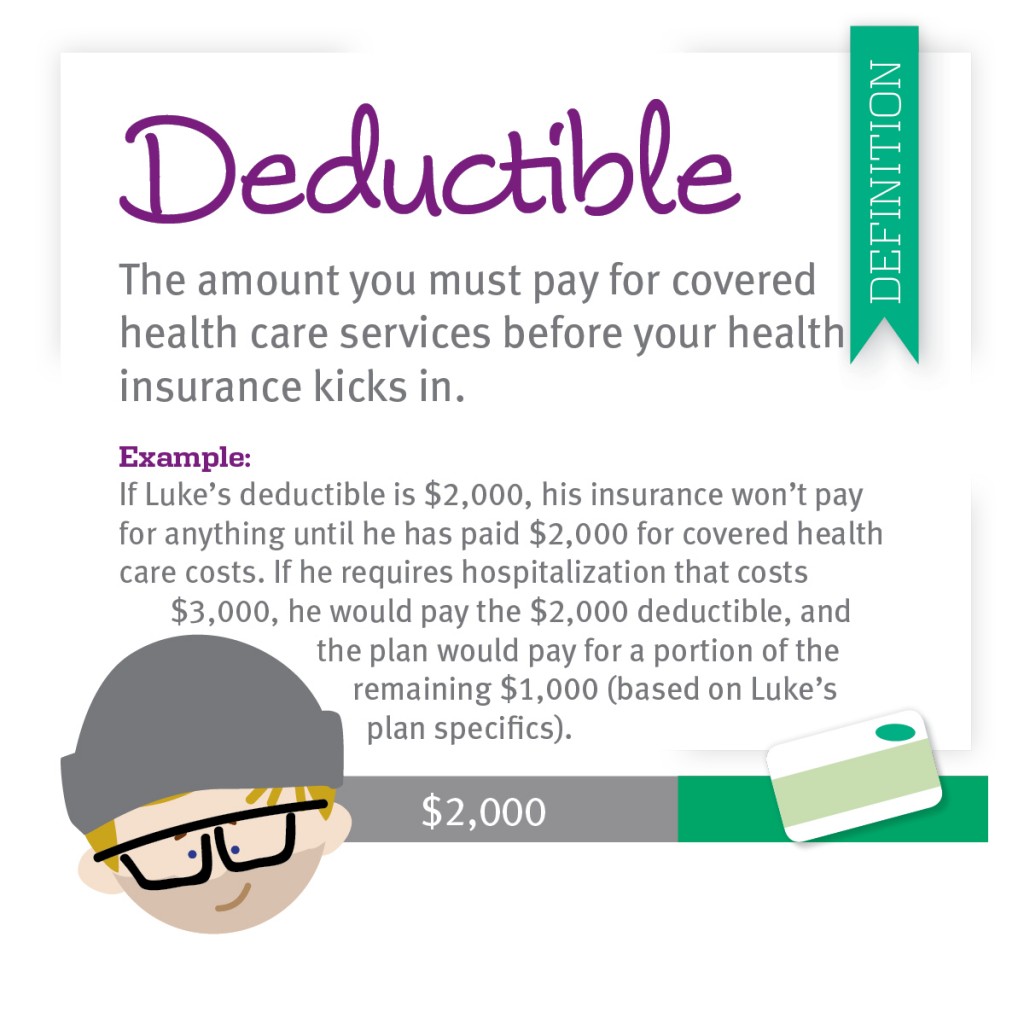

What’s a Calendar Yr Deductible?

A calendar yr deductible is the sum of money you, the insured, should pay out-of-pocket for lined medical bills earlier than your medical insurance plan begins to pay its share. Crucially, this deductible resets originally of every calendar yr (January 1st) no matter once you incurred your first lined expense. Which means that even when you paid half or all your deductible in December, you will have to begin over once more from zero in January.

Let’s illustrate with an instance: Suppose you will have a medical insurance plan with a $2,000 calendar yr deductible. You go to the physician in November and incur $1,000 in medical payments. Your insurance coverage firm won’t pay something till you have met your $2,000 deductible. In December, you require additional medical consideration, leading to one other $1,500 in payments. You have now reached your $2,000 deductible ($1,000 + $1,500). Nevertheless, when January rolls round, your deductible resets to $2,000, and you will have to begin paying out-of-pocket once more earlier than your insurance coverage kicks in.

How Does it Differ from Different Deductibles?

The important thing distinction of a calendar yr deductible lies in its annual reset. This contrasts with different deductible varieties, corresponding to:

-

Per-incident deductible: This kind of deductible applies to every separate incident or declare. For instance, when you have a automotive accident and file a declare, you might need a $500 per-incident deductible. You’ll pay this $500 for that particular accident, and a subsequent accident would require you to pay the deductible once more.

-

Per-claim deductible: Just like the per-incident deductible, this is applicable to every particular person declare, no matter whether or not a number of incidents are concerned in a single declare.

-

Annual deductible (non-calendar yr): This deductible resets yearly, however the "annual" interval is not essentially tied to the calendar yr. It’d align along with your coverage’s anniversary date, for instance.

-

Household deductible: That is frequent in medical insurance plans and applies to your entire household. As soon as the household collectively meets the deductible quantity, the insurance coverage firm begins paying advantages for all members of the family.

Understanding these variations is significant as a result of they considerably influence your out-of-pocket bills. A calendar yr deductible can result in greater prices when you have a number of medical occasions unfold throughout the yr, whereas a per-incident deductible may be extra manageable when you expertise rare, high-cost occasions.

Implications of a Calendar Yr Deductible:

The implications of a calendar yr deductible are important, significantly for people with ongoing or continual well being circumstances. These implications embrace:

-

Greater Out-of-Pocket Prices: Essentially the most speedy implication is the potential for greater out-of-pocket bills. People requiring frequent medical consideration all year long would possibly discover themselves repeatedly reaching their deductible, resulting in substantial funds.

-

Monetary Planning Challenges: Predicting healthcare bills might be troublesome. A calendar yr deductible necessitates cautious monetary planning to account for potential medical prices all year long. Surprising medical emergencies can create important monetary pressure.

-

Impression on Healthcare Choices: The existence of a deductible would possibly affect healthcare choices. People would possibly delay looking for crucial medical care resulting from issues about exceeding their deductible, probably worsening well being circumstances.

-

Negotiating with Suppliers: Understanding your deductible can empower you to barter with healthcare suppliers. Understanding your remaining deductible quantity may also help you talk about cost plans or discover cost-effective remedy choices.

Methods for Managing Calendar Yr Deductibles:

Whereas calendar yr deductibles are a set side of many insurance policy, there are methods to handle their influence:

-

Well being Financial savings Account (HSA): If in case you have a high-deductible well being plan (HDHP), contributing to an HSA could be a tax-advantaged method to save for healthcare bills. HSA funds can be utilized to pay for deductibles and different certified medical bills.

-

Versatile Spending Account (FSA): Just like an HSA, an FSA permits pre-tax contributions for use for medical bills. Nevertheless, FSAs typically have stricter utilization guidelines and will not roll over unused funds to the following yr.

-

Budgeting and Saving: Cautious budgeting and saving for anticipated healthcare prices can mitigate the monetary burden of a calendar yr deductible. Think about setting apart a portion of your earnings every month to cowl potential medical bills.

-

Preventive Care: Benefiting from preventive care providers, corresponding to annual checkups and vaccinations, may also help stop extra expensive well being points later within the yr.

-

Understanding Your Coverage: Completely reviewing your insurance coverage coverage to grasp the particular phrases and circumstances of your calendar yr deductible is important. Clarifying any uncertainties along with your insurance coverage supplier can stop misunderstandings and disputes.

Conclusion:

The calendar yr deductible is a major factor of many insurance policy, impacting each monetary planning and healthcare decision-making. Understanding its implications, evaluating it with different deductible varieties, and using efficient administration methods are essential for minimizing its monetary burden. By rigorously reviewing your coverage, using tax-advantaged financial savings accounts, and proactively managing your healthcare, you possibly can navigate the complexities of calendar yr deductibles and make sure you obtain the mandatory medical care with out undue monetary pressure. Do not forget that proactive communication along with your insurance coverage supplier is essential to making sure you will have a transparent understanding of your protection and obligations. Do not hesitate to succeed in out to them when you have any questions or require clarification in your particular plan’s deductible construction.

Closure

Thus, we hope this text has offered helpful insights into Understanding Calendar Yr Deductibles: A Complete Information. We respect your consideration to our article. See you in our subsequent article!