Navigating the ADP Bi-Weekly Payroll Calendar 2025: A Complete Information for Employers and Workers

Associated Articles: Navigating the ADP Bi-Weekly Payroll Calendar 2025: A Complete Information for Employers and Workers

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Navigating the ADP Bi-Weekly Payroll Calendar 2025: A Complete Information for Employers and Workers. Let’s weave fascinating data and provide recent views to the readers.

Desk of Content material

Navigating the ADP Bi-Weekly Payroll Calendar 2025: A Complete Information for Employers and Workers

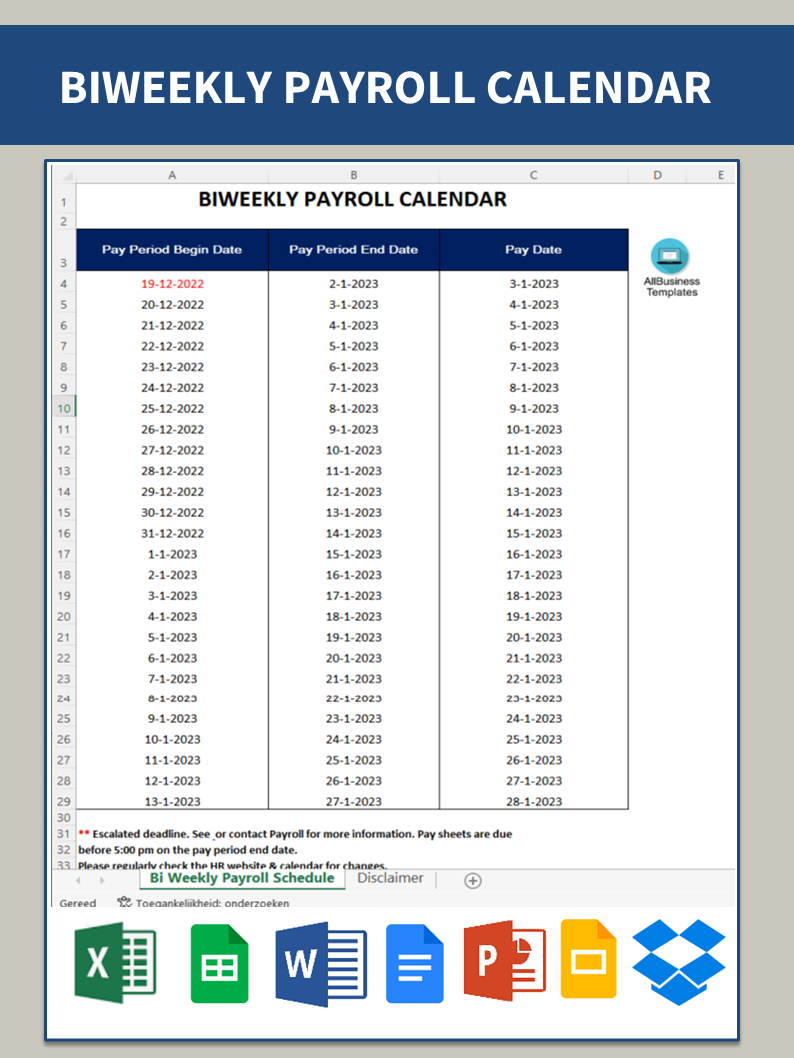

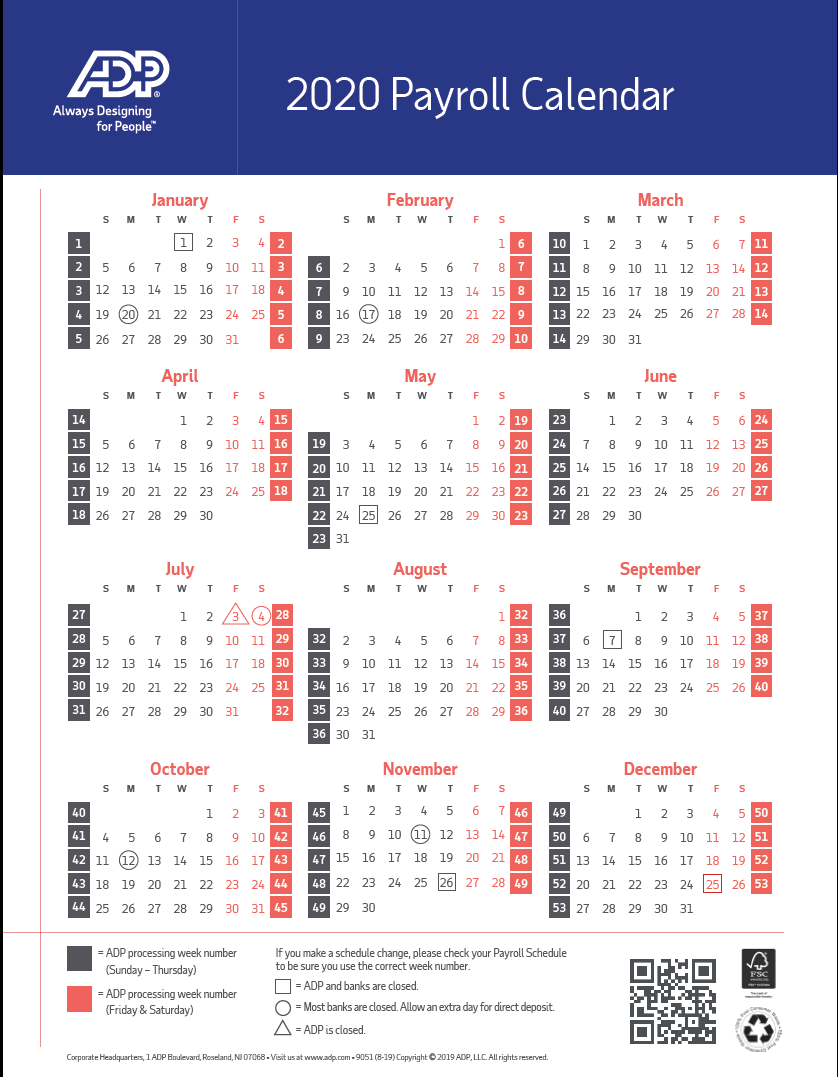

The ADP bi-weekly payroll calendar for 2025 is an important instrument for companies using ADP’s payroll companies. Understanding its intricacies is important for each employers, making certain correct and well timed compensation for his or her workers, and workers, permitting them to anticipate their paycheck arrival. This text gives a complete information to navigating the 2025 ADP bi-weekly payroll calendar, overlaying its construction, potential variations, and tips on how to greatest put it to use for efficient monetary planning.

Understanding the Bi-Weekly Payroll Cycle:

Not like semi-monthly payroll (paid twice a month on fastened dates), a bi-weekly payroll system pays workers each two weeks. This implies there are 26 pay durations in a yr, whatever the variety of days in every month. This consistency may be helpful for budgeting and monetary planning for each employers and workers, making a predictable revenue stream. Nevertheless, the precise pay dates will shift all year long because of the various lengths of months.

The ADP Bi-Weekly Payroll Calendar 2025: Key Issues:

The ADP bi-weekly payroll calendar for 2025, whereas not publicly obtainable as a single, universally accessible doc, is generated internally inside the ADP system primarily based on an organization’s particular setup. This implies the precise dates will range relying on:

- Firm’s Payday Choice: The preliminary payday chosen by the corporate initially of their ADP payroll setup dictates the next paydays. An organization may select a selected day of the week (e.g., at all times Friday) or a selected date vary.

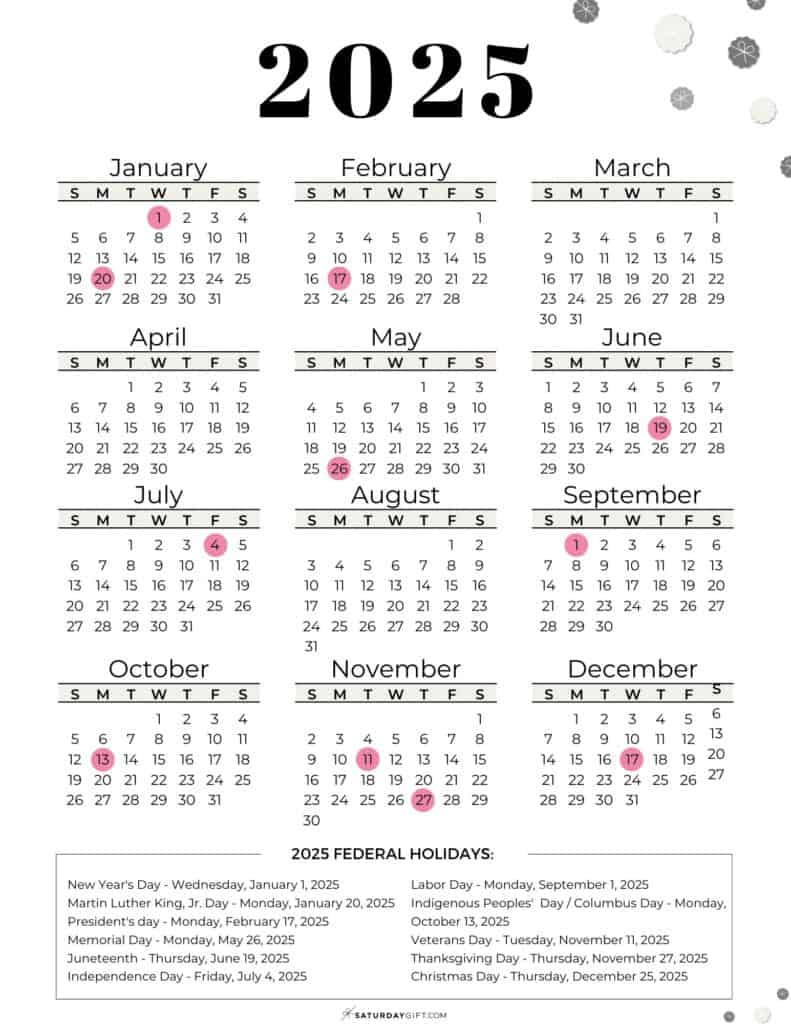

- Holidays and Noticed Holidays: Authorized holidays and company-observed holidays will impression payday schedules. If a payday falls on a vacation, the cost is perhaps shifted to the previous or following enterprise day. ADP’s system mechanically adjusts for these variations, but it surely’s important for employers to pay attention to these potential shifts.

- Yr-Finish Changes: The ultimate pay interval of the yr is perhaps barely totally different in size to accommodate the transition to the brand new yr. It is a widespread incidence in any bi-weekly payroll system.

Accessing Your ADP Bi-Weekly Payroll Calendar:

Accessing the exact payroll calendar for 2025 requires logging into your organization’s ADP portal. The situation of this calendar inside the ADP system varies relying on the precise ADP payroll software program your organization makes use of (e.g., ADP Workforce Now, ADP RUN). Sometimes, you may discover it beneath sections like "Payroll Calendar," "Pay Schedules," or the same designation inside the payroll administration part. If you cannot find it, contact your organization’s HR or payroll division for help.

Using the ADP Payroll Calendar for Efficient Monetary Planning:

Each employers and workers can leverage the ADP bi-weekly payroll calendar for enhanced monetary planning:

For Employers:

- Budgeting and Forecasting: The constant bi-weekly schedule permits for extra correct budgeting and forecasting of payroll bills. Employers can predict their money stream extra reliably, simplifying monetary planning and useful resource allocation.

- Tax Planning: Figuring out the precise pay dates helps in correct tax calculations and well timed tax funds. This minimizes the chance of penalties and ensures compliance with tax laws.

- Worker Compensation Administration: Correct payroll scheduling ensures workers obtain their compensation on time, fostering worker satisfaction and lowering administrative burdens.

- Yr-Finish Processing: Understanding the year-end changes permits employers to plan for W-2 preparation and year-end reporting effectively.

For Workers:

- Budgeting and Expense Monitoring: The predictable revenue stream facilitates higher private budgeting. Workers can create lifelike budgets, observe bills, and handle their funds extra successfully.

- Debt Administration: Figuring out the precise pay dates helps in managing debt repayments successfully. Workers can plan their funds to coincide with their revenue, lowering the chance of late funds and penalties.

- Financial savings and Funding Planning: The constant revenue permits for higher financial savings and funding planning. Workers can set lifelike financial savings targets and automate their investments accordingly.

- Avoiding Overspending: Predictable revenue helps in avoiding overspending and impulsive purchases. Workers can persist with their budgets and keep away from monetary stress.

Potential Challenges and Options:

Whereas the bi-weekly payroll system gives advantages, it additionally presents some challenges:

- Various Pay Interval Lengths: The slight variations within the size of pay durations (because of the various variety of days in months) could make budgeting barely extra complicated. Utilizing budgeting instruments and apps that accommodate irregular pay durations can mitigate this.

- Vacation Shifts: The shifting of paydays as a result of holidays can disrupt established routines. Staying knowledgeable concerning the calendar and anticipating potential shifts is essential.

- System Errors: Whereas uncommon, errors can happen inside the ADP system. Recurrently checking the calendar and pay stubs for accuracy is necessary. Reporting any discrepancies to the payroll division promptly is important.

Proactive Measures for Clean Payroll Administration:

- Common Communication: Open communication between employers and workers relating to the payroll calendar is essential. Employers ought to make sure the calendar is quickly accessible to workers and promptly talk any adjustments or changes.

- Correct Knowledge Entry: Employers should guarantee correct knowledge entry into the ADP system to forestall payroll errors. Common knowledge verification and reconciliation are important.

- System Updates: Staying up to date with the newest ADP software program updates and options ensures optimum payroll processing and minimizes potential points.

- Worker Coaching: Offering workers with enough coaching on accessing and understanding the ADP payroll calendar can improve their monetary literacy and planning capabilities.

Conclusion:

The ADP bi-weekly payroll calendar for 2025 is a crucial instrument for environment friendly payroll administration. By understanding its construction, accessing it appropriately, and using its data successfully, each employers and workers can streamline monetary planning and guarantee clean payroll processing all year long. Proactive measures, open communication, and correct knowledge administration are essential for maximizing the advantages of the ADP bi-weekly payroll system and minimizing potential challenges. Bear in mind to at all times seek the advice of your organization’s HR or payroll division for any particular questions or clarifications relating to your organization’s payroll schedule.

Closure

Thus, we hope this text has supplied precious insights into Navigating the ADP Bi-Weekly Payroll Calendar 2025: A Complete Information for Employers and Workers. We thanks for taking the time to learn this text. See you in our subsequent article!