Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

Associated Articles: Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

Introduction

With enthusiasm, let’s navigate by means of the intriguing subject associated to Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information. Let’s weave attention-grabbing info and supply recent views to the readers.

Desk of Content material

Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information

The 12 months 2025 is quick approaching, and with it comes the necessity for companies to arrange their payroll schedules. For organizations working on a semi-monthly payroll system, correct and well timed processing is essential for sustaining worker satisfaction and regulatory compliance. This complete information gives an in depth take a look at the 2025 semi-monthly payroll calendar, providing insights into scheduling finest practices, potential challenges, and methods for efficient payroll administration.

Understanding Semi-Month-to-month Payroll:

Semi-monthly payroll means staff are paid twice a month, sometimes on a set schedule, such because the fifteenth and the final day of the month. This differs from bi-weekly payroll, which includes funds each two weeks, leading to barely various pay dates all year long. The selection between semi-monthly and bi-weekly depends upon numerous components, together with firm measurement, business requirements, and inside accounting practices. Semi-monthly presents the benefit of constant pay dates, making budgeting simpler for workers. Nevertheless, the variety of pay intervals per 12 months varies barely (24) in comparison with bi-weekly (26).

The 2025 Semi-Month-to-month Payroll Calendar: A Framework

Making a exact 2025 semi-monthly payroll calendar requires cautious consideration of weekends and holidays. Whereas a easy "fifteenth and final day" rule works in concept, it wants adjustment to account for these non-working days. A strong calendar will specify the precise pay dates, contemplating the next:

- Weekends: If the fifteenth or the final day of the month falls on a weekend, the payroll needs to be processed on the previous Friday.

- Holidays: Federal and state holidays considerably impression payroll scheduling. If a pay date coincides with a vacation, the payroll needs to be processed on the previous workday. This requires a proactive method, anticipating holidays nicely upfront.

- 12 months-Finish Changes: The ultimate pay interval of the 12 months usually requires further consideration, significantly concerning year-end bonuses, tax withholdings, and the potential want for changes to make sure correct reporting.

Constructing Your 2025 Semi-Month-to-month Payroll Calendar:

To create your individual 2025 semi-monthly payroll calendar, you may make the most of numerous strategies:

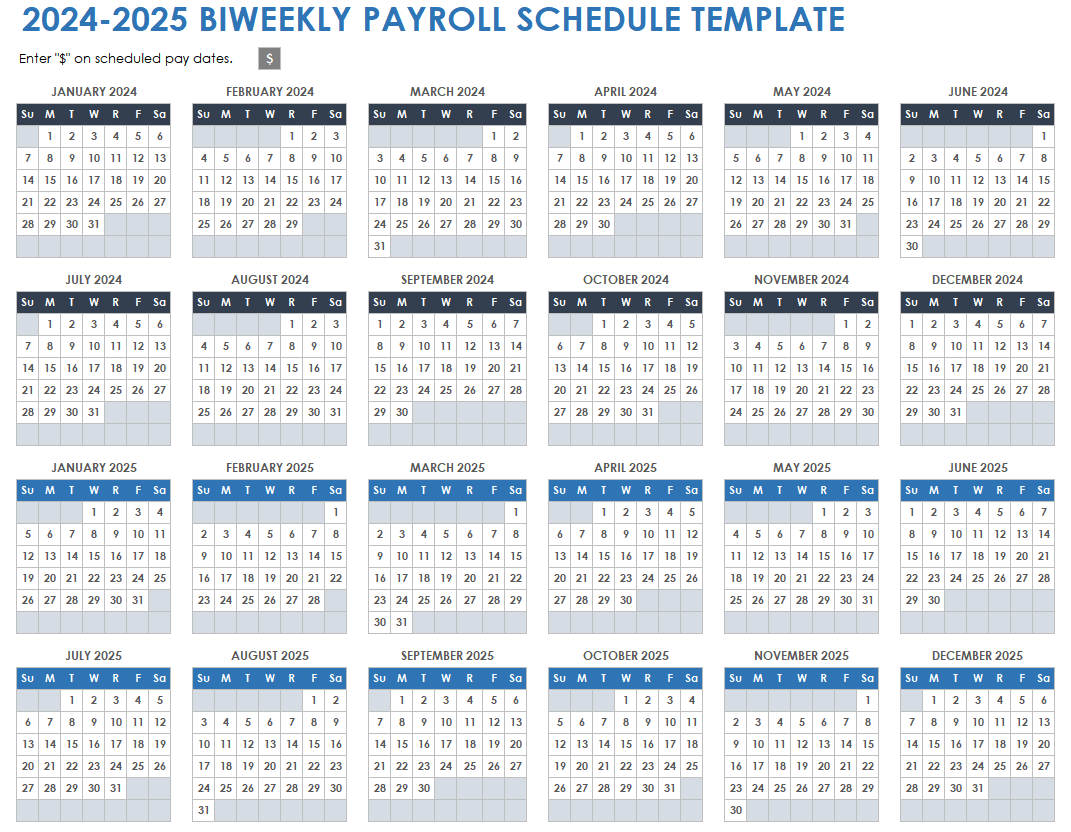

- Spreadsheet Software program (Excel, Google Sheets): That is arguably the most typical and versatile methodology. You may create a spreadsheet with columns for the month, the fifteenth, the final day of the month, and the adjusted pay date, factoring in weekends and holidays. Formulation can automate the adjustment course of, minimizing handbook errors.

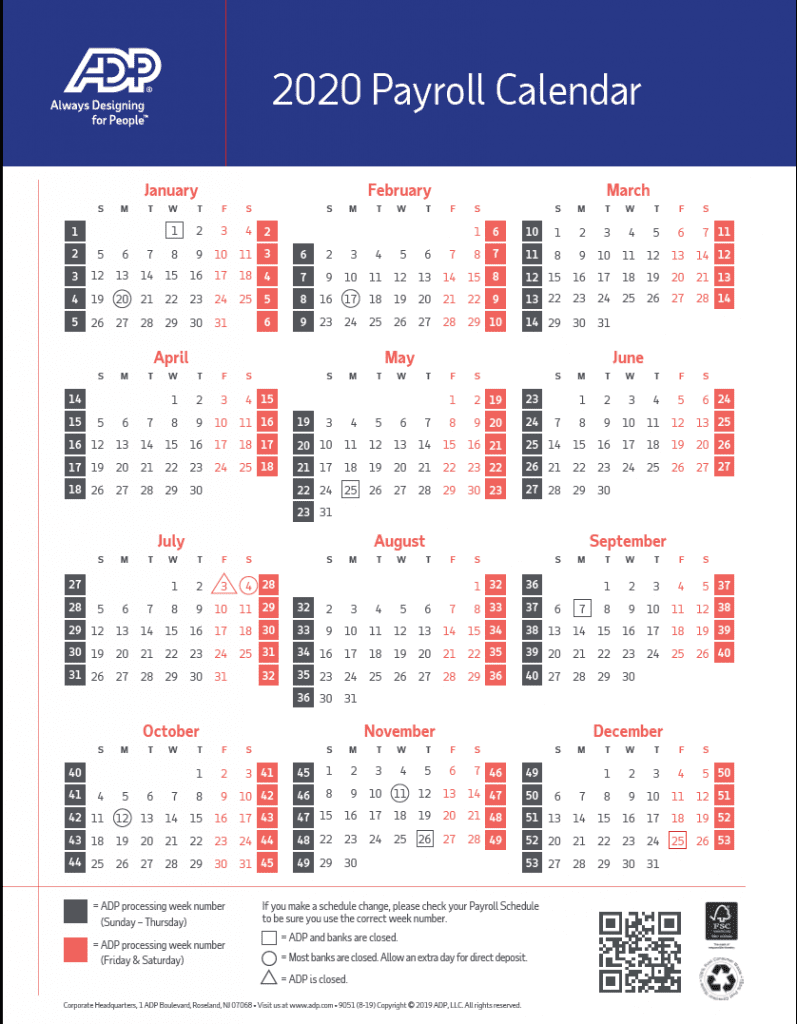

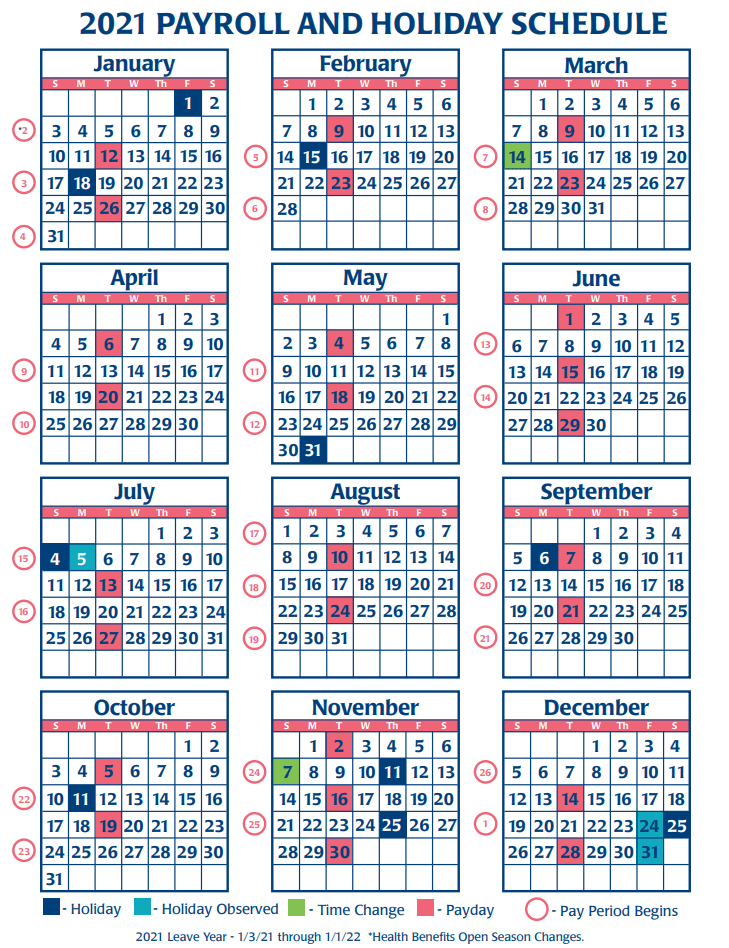

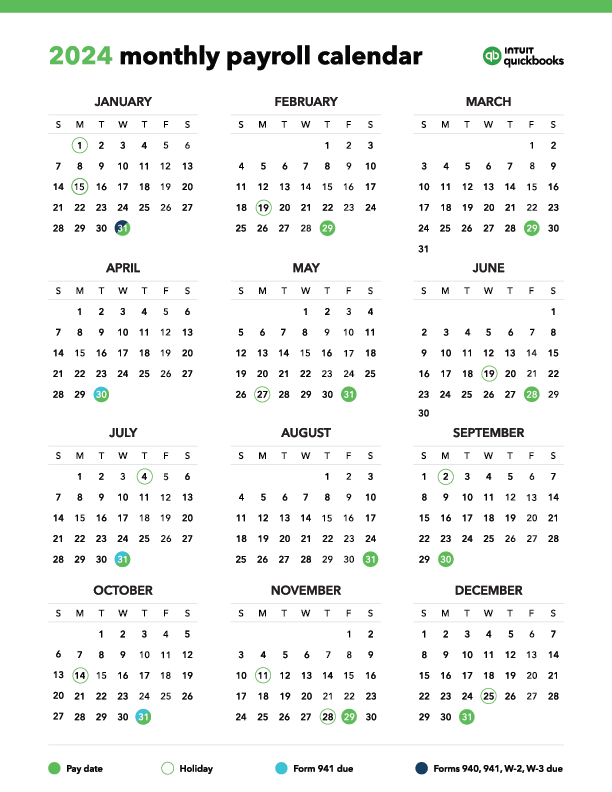

- Payroll Software program: Many payroll software program options embody calendar options that robotically generate pay dates, considering weekends and holidays. It is a extremely really helpful method for companies dealing with a major variety of staff.

- On-line Payroll Calendar Mills: A number of web sites supply free or paid companies to generate payroll calendars. These instruments usually enable customization primarily based on particular vacation schedules and firm preferences.

Instance of a Partial 2025 Semi-Month-to-month Payroll Calendar:

(Observe: It is a pattern and does not account for all holidays. At all times check with official vacation calendars to your particular location.)

| Month | fifteenth | Final Day of Month | Adjusted Pay Date |

|---|---|---|---|

| January | Friday, Jan 17 | Thursday, Jan 31 | Thursday, Jan 31 |

| February | Saturday, Feb 15 | Wednesday, Feb 28 | Friday, Feb 28 |

| March | Sunday, Mar 15 | Friday, Mar 31 | Friday, Mar 28 |

| April | Tuesday, Apr 15 | Wednesday, Apr 30 | Wednesday, Apr 30 |

| Could | Thursday, Could 15 | Sunday, Could 31 | Friday, Could 30 |

| June | Sunday, Jun 15 | Monday, Jun 30 | Friday, Jun 27 |

| July | Tuesday, Jul 15 | Wednesday, Jul 31 | Wednesday, Jul 31 |

| August | Friday, Aug 15 | Saturday, Aug 30 | Friday, Aug 29 |

| September | Monday, Sep 15 | Wednesday, Sep 30 | Wednesday, Sep 30 |

| October | Wednesday, Oct 15 | Saturday, Oct 31 | Friday, Oct 31 |

| November | Sunday, Nov 15 | Friday, Nov 28 | Friday, Nov 28 |

| December | Monday, Dec 15 | Thursday, Dec 31 | Thursday, Dec 31 |

Addressing Potential Challenges:

- Vacation Variations: State and native holidays can differ from federal holidays. Guarantee your calendar accounts for all related holidays impacting your workforce.

- System Integration: If utilizing a number of methods for payroll, time monitoring, and HR, guarantee seamless integration to keep away from information discrepancies and delays.

- 12 months-Finish Processing: 12 months-end payroll requires meticulous consideration to element, together with W-2 preparation, tax changes, and bonus funds. Start planning nicely upfront.

- Worker Communication: Clearly talk the payroll schedule to staff, offering ample discover of any modifications or changes.

Greatest Practices for Semi-Month-to-month Payroll Administration:

- Proactive Planning: Create your calendar nicely upfront of the 12 months’s graduation.

- Common Evaluate: Periodically assessment and replace the calendar to account for any unexpected modifications or changes.

- Information Accuracy: Prioritize information accuracy all through the payroll course of to reduce errors and potential authorized points.

- Automation: Leverage know-how to automate as a lot of the payroll course of as doable, bettering effectivity and decreasing handbook effort.

- Compliance: Keep up-to-date with all related federal, state, and native payroll laws.

- Worker Self-Service: Implement worker self-service portals for accessing pay stubs, tax info, and different related payroll information.

Conclusion:

A well-planned 2025 semi-monthly payroll calendar is important for easy and environment friendly payroll processing. By proactively contemplating weekends, holidays, and potential challenges, companies can decrease disruptions and guarantee correct and well timed funds to their staff. Using applicable know-how and adhering to finest practices will contribute to a extra streamlined and compliant payroll course of, fostering optimistic worker relations and sustaining a wholesome monetary standing for the group. Keep in mind that this text gives common steerage; at all times seek the advice of with payroll professionals or authorized specialists to make sure compliance with particular laws in your location. The supplied instance calendar is illustrative and needs to be tailored to mirror the precise holidays and enterprise necessities. Correct and well timed payroll is not only a matter of effectivity; it is a important part of accountable enterprise administration.

Closure

Thus, we hope this text has supplied invaluable insights into Navigating the 2025 Semi-Month-to-month Payroll Calendar: A Complete Information. We admire your consideration to our article. See you in our subsequent article!