Navigating the 2025 Direct Deposit Calendar for Retirees: A Complete Information

Associated Articles: Navigating the 2025 Direct Deposit Calendar for Retirees: A Complete Information

Introduction

With enthusiasm, let’s navigate by the intriguing subject associated to Navigating the 2025 Direct Deposit Calendar for Retirees: A Complete Information. Let’s weave fascinating data and supply contemporary views to the readers.

Desk of Content material

Navigating the 2025 Direct Deposit Calendar for Retirees: A Complete Information

Retirement ought to be a time of rest and pleasure, not stress over funds. An important side of easy retirement planning is knowing your fee schedule. For a lot of retirees, this implies counting on the accuracy and timeliness of their Social Safety and pension direct deposits. This text serves as a complete information to navigating the 2025 direct deposit calendar for retirees, addressing widespread questions and providing useful suggestions for managing your funds successfully.

Understanding the 2025 Fee Schedule: A Take a look at the Fundamentals

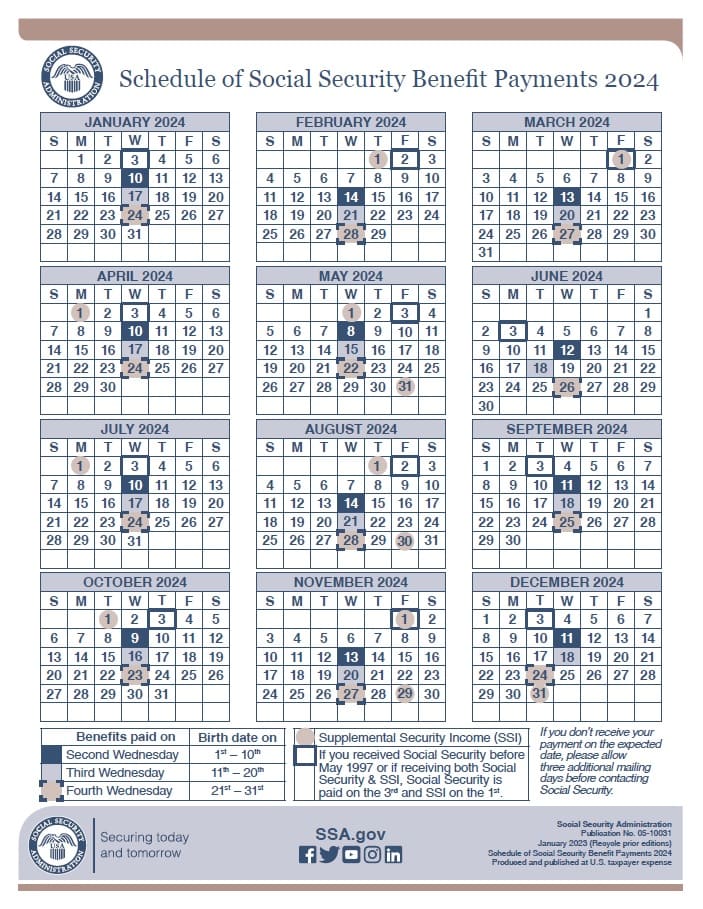

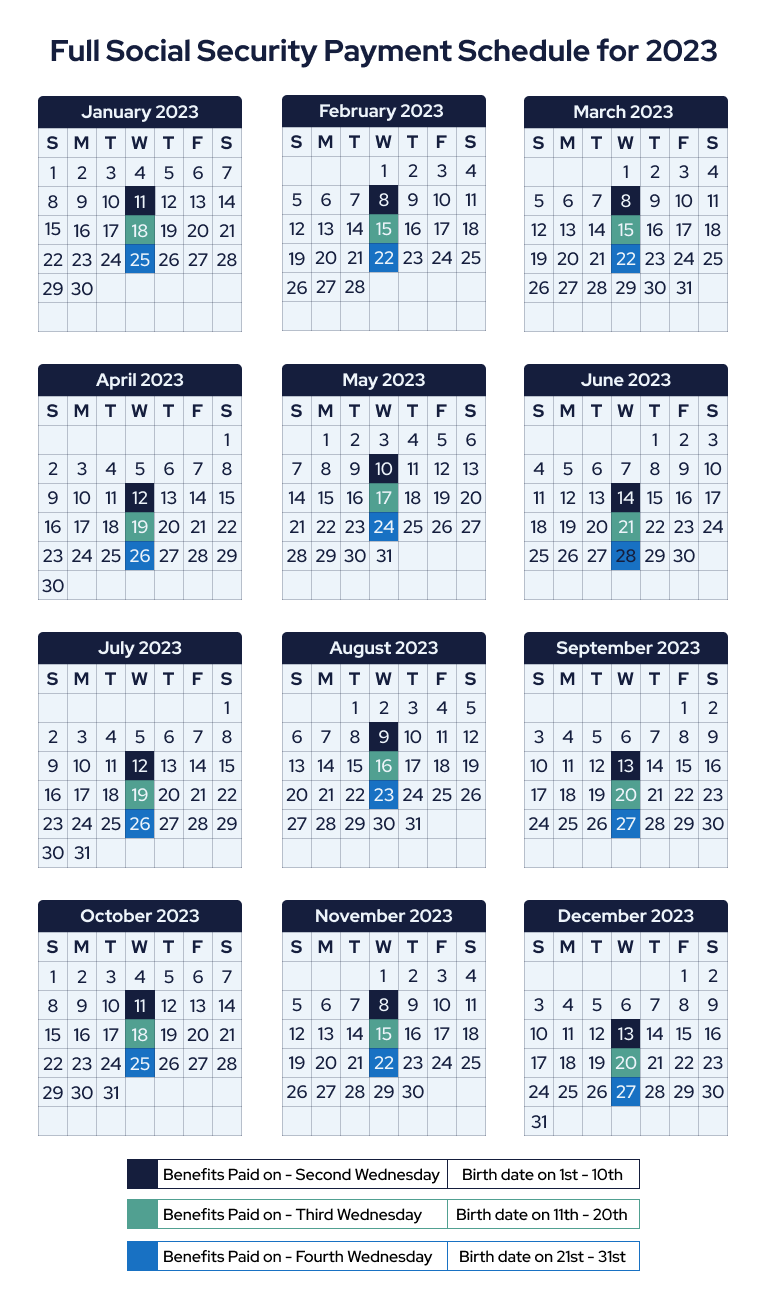

The 2025 direct deposit schedule for Social Safety and different retirement advantages will largely comply with the established sample of earlier years. Nevertheless, it is essential to keep in mind that particular fee dates will be influenced by weekends and holidays. The Social Safety Administration (SSA) and different pension suppliers usually adhere to a pre-determined schedule, making certain funds are made on the identical day of the week every month, except a vacation falls on that day. In such circumstances, the fee is often superior to the previous Friday.

Key Issues for Retirees:

-

Federal Holidays: The 2025 federal vacation calendar considerably impacts fee dates. When a fee date falls on a weekend or vacation, the fee will probably be deposited on the previous enterprise day. Familiarize your self with the 2025 federal vacation schedule to anticipate any shifts in your fee dates. That is particularly essential for budgeting and planning bills.

-

Social Safety Fee Dates: Social Safety advantages are usually paid on the second, third, or fourth Wednesday of the month, relying in your delivery date. The particular day to your fee stays constant all year long, except affected by a vacation. The SSA web site supplies a instrument to find out your particular fee date primarily based in your delivery date and 12 months.

-

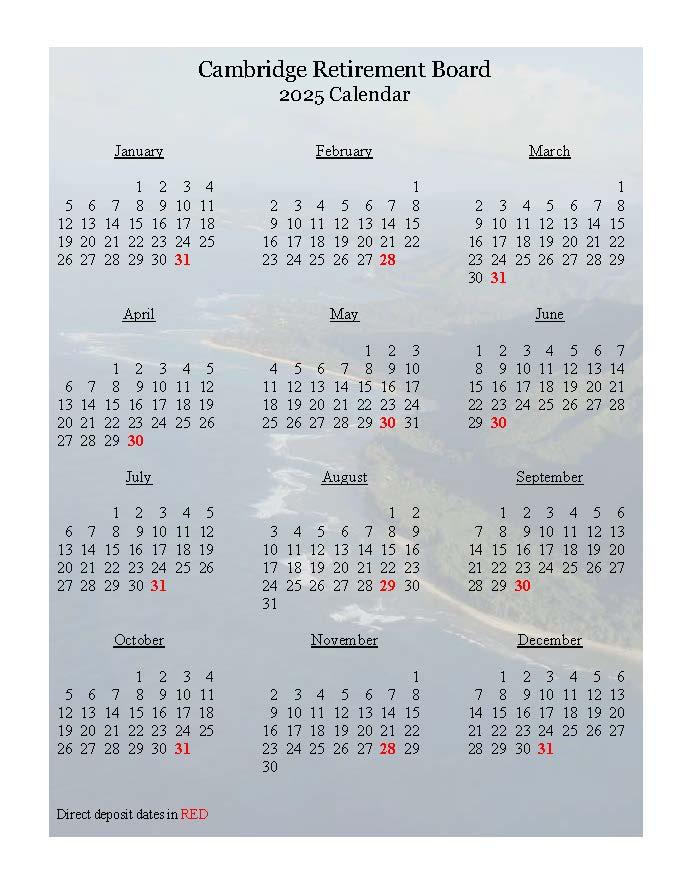

Pension Fee Dates: Pension fee schedules differ relying on the particular plan supplier. Test your pension plan paperwork or contact your supplier on to acquire the 2025 fee calendar. Non-public pension plans could not comply with the identical schedule as Social Safety.

-

State and Native Authorities Pensions: Just like personal pensions, state and native authorities pension fee schedules can differ. Contact your pension supplier for particular fee data for 2025.

Making a Personalised 2025 Direct Deposit Calendar:

Whereas a generic calendar outlining federal holidays is not ample, retirees can create a personalised calendar incorporating their particular fee dates. This customized calendar is a useful instrument for efficient monetary administration. This is learn how to create one:

-

Acquire your fee schedule: Contact the SSA or your pension supplier to verify your 2025 fee dates.

-

Obtain a 2025 calendar: Use a digital calendar or print a bodily one.

-

Mark your fee dates: For every month, mark the particular day your Social Safety and pension advantages will probably be deposited.

-

Embrace invoice due dates: Add essential invoice due dates (mortgage, utilities, bank cards, and so forth.) to your calendar. This helps visualize your money stream and guarantee well timed funds.

-

Word any anticipated bills: Embrace any deliberate bills, akin to journey, medical appointments, or residence repairs. This holistic strategy supplies a transparent image of your month-to-month earnings and outgoings.

-

Often overview and replace: Preserve your calendar up to date all year long to account for any modifications in your fee dates or bills.

Managing Your Funds with Your 2025 Direct Deposit Calendar:

Your customized calendar is greater than only a schedule; it is a highly effective instrument for managing your retirement funds successfully. Listed below are some methods:

-

Budgeting: Use the calendar to create a practical price range that aligns together with your earnings and bills. This prevents overspending and ensures you’ve sufficient funds to cowl all of your obligations.

-

Invoice Fee Automation: Arrange computerized funds for recurring payments to keep away from late charges and guarantee well timed funds. This eliminates the danger of forgetting to pay payments and simplifies your monetary administration.

-

Emergency Fund: Allocate a portion of your month-to-month earnings to an emergency fund. This fund supplies a monetary security web in case of sudden bills or emergencies.

-

Monitoring Spending: Monitor your spending habits all through the month to establish areas the place you may probably get monetary savings. This ensures your spending aligns together with your price range and targets.

-

Investing: Contemplate investing a portion of your retirement earnings to generate extra earnings and probably enhance your wealth over time. Seek the advice of with a monetary advisor to find out the most effective funding technique to your circumstances.

-

Tax Planning: Perceive the tax implications of your retirement earnings and plan accordingly. Contemplate consulting with a tax skilled to optimize your tax technique.

Addressing Potential Challenges and Options:

-

Delayed Funds: Whereas uncommon, fee delays can happen. In case your fee is delayed, contact the SSA or your pension supplier instantly to research the rationale for the delay.

-

Account Modifications: Should you change your checking account or handle, notify the SSA and your pension supplier promptly to make sure your funds are deposited into the proper account.

-

Fraudulent Exercise: Be vigilant towards fraudulent exercise and report any suspicious exercise to the suitable authorities instantly. Often overview your financial institution statements for any unauthorized transactions.

Conclusion:

The 2025 direct deposit calendar is an important instrument for retirees to handle their funds successfully. By understanding the fee schedule, creating a personalised calendar, and implementing sound monetary administration methods, retirees can get pleasure from a safe and cozy retirement. Proactive planning and common monitoring of your funds will guarantee peace of thoughts and assist you to concentrate on the thrill of retirement. Bear in mind to repeatedly test the official web sites of the SSA and your pension supplier for any updates or modifications to the fee schedule. Do not hesitate to hunt skilled monetary recommendation for those who require help with budgeting, investing, or tax planning. Your retirement deserves cautious planning and a spotlight to element, making certain a financially safe and fulfilling future.

Closure

Thus, we hope this text has supplied helpful insights into Navigating the 2025 Direct Deposit Calendar for Retirees: A Complete Information. We recognize your consideration to our article. See you in our subsequent article!