Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Workers

Associated Articles: Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Workers

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Workers. Let’s weave fascinating info and provide recent views to the readers.

Desk of Content material

Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Workers

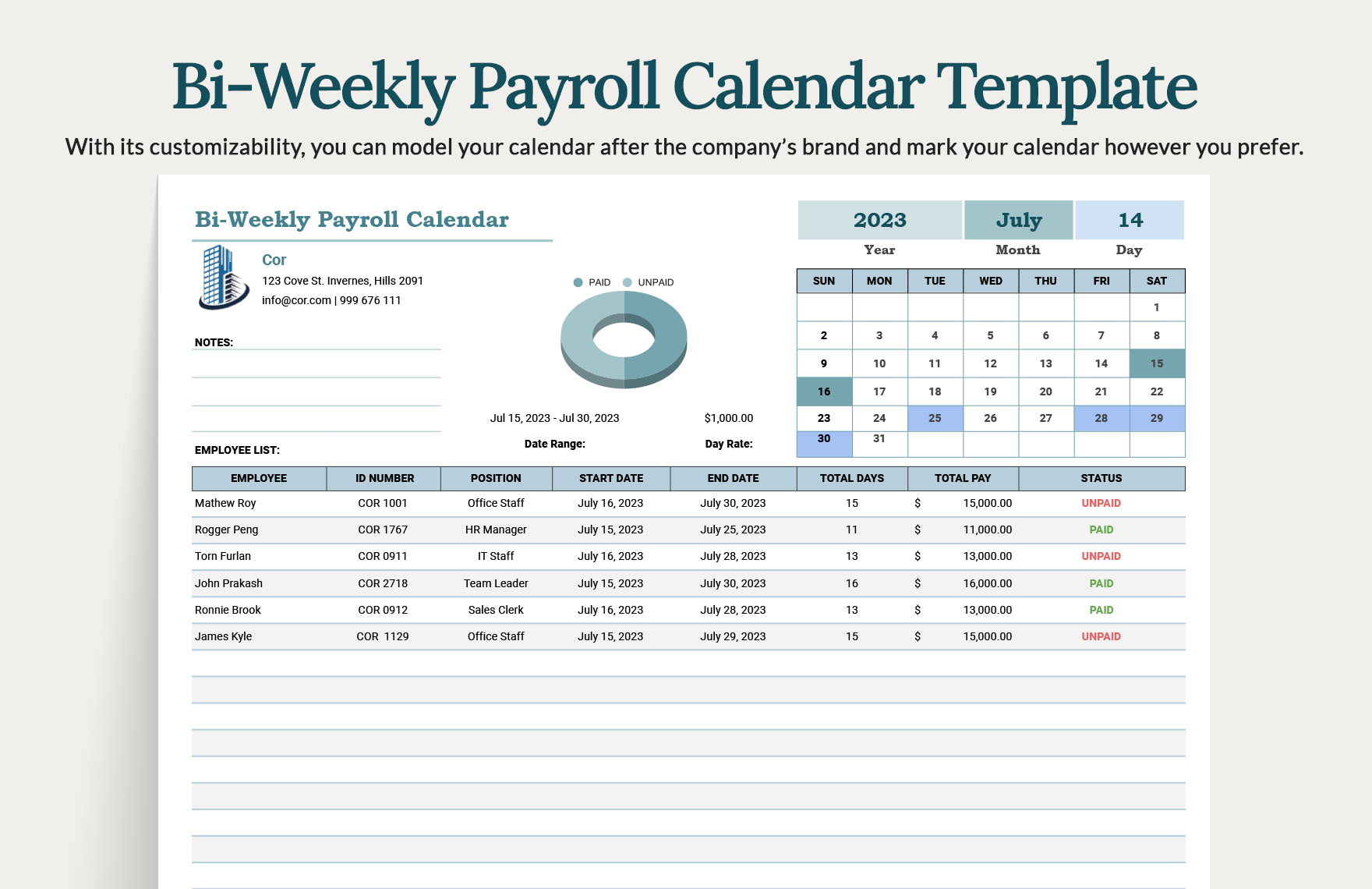

The 12 months 2025 is quickly approaching, and with it comes the necessity for meticulous planning, particularly regarding payroll. For companies working on a bi-weekly payroll schedule, correct and well timed processing is essential for sustaining worker morale, adhering to authorized necessities, and guaranteeing clean monetary operations. This complete information supplies an in depth overview of the 2025 bi-weekly payroll calendar, providing invaluable insights for each employers and staff.

Understanding the Bi-Weekly Payroll Cycle:

A bi-weekly payroll cycle means staff are paid each two weeks, leading to 26 pay intervals per 12 months. Not like a semi-monthly payroll (paid twice a month on mounted dates), the precise pay dates shift all year long. This fluctuation can generally trigger confusion, particularly when coping with holidays and ranging month lengths.

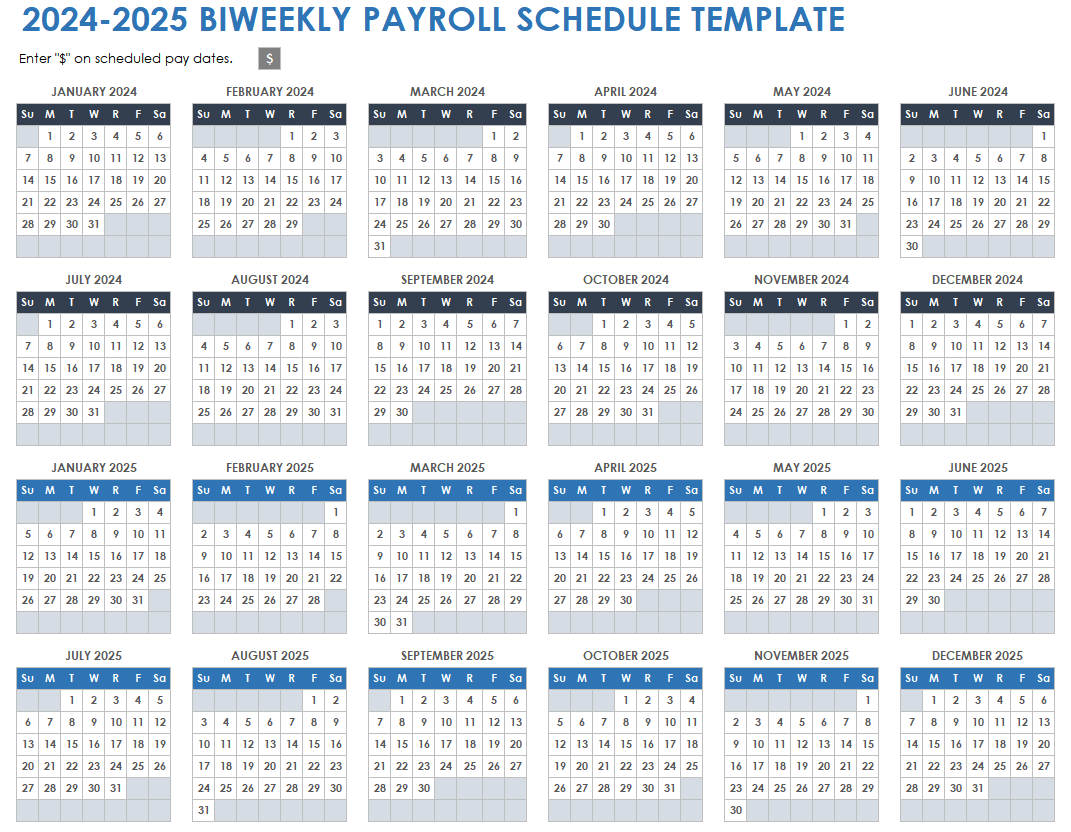

Establishing the 2025 Bi-Weekly Payroll Calendar:

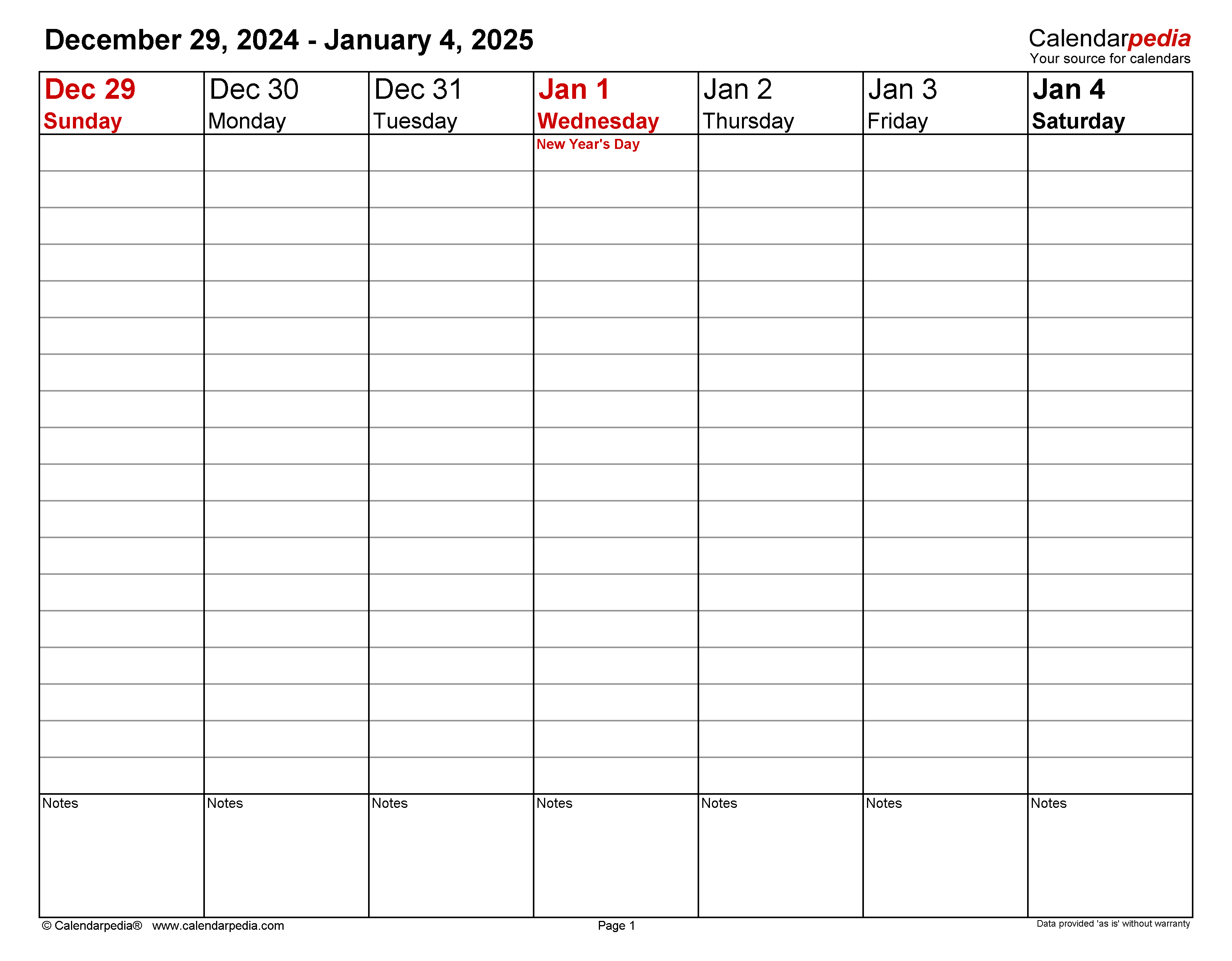

The 2025 bi-weekly payroll calendar’s particular dates rely totally on the chosen begin date of the primary pay interval. There is no such thing as a single "appropriate" calendar; the schedule is decided by the employer’s inner coverage. Nonetheless, we are able to illustrate a attainable calendar based mostly on a standard place to begin. For this instance, we’ll assume the primary pay interval of 2025 begins on Sunday, January fifth, 2025, and ends on Saturday, January 18th, 2025. The payday for this era would usually fall on the next Friday, January seventeenth, 2025.

This place to begin permits us to generate a pattern calendar:

(Observe: This can be a pattern calendar. Your precise payroll calendar will rely in your chosen begin date and firm coverage. All the time confirm your organization’s particular schedule.)

| Pay Interval | Pay Interval Begin Date | Pay Interval Finish Date | Payday (Friday) |

|---|---|---|---|

| 1 | Sunday, January fifth, 2025 | Saturday, January 18th, 2025 | Friday, January seventeenth, 2025 |

| 2 | Sunday, January nineteenth, 2025 | Saturday, February 1st, 2025 | Friday, January thirty first, 2025 |

| 3 | Sunday, February 2nd, 2025 | Saturday, February fifteenth, 2025 | Friday, February 14th, 2025 |

| 4 | Sunday, February sixteenth, 2025 | Saturday, March 1st, 2025 | Friday, February twenty eighth, 2025 |

| 5 | Sunday, March 2nd, 2025 | Saturday, March fifteenth, 2025 | Friday, March 14th, 2025 |

| 6 | Sunday, March sixteenth, 2025 | Saturday, March twenty ninth, 2025 | Friday, March twenty eighth, 2025 |

| 7 | Sunday, March thirtieth, 2025 | Saturday, April twelfth, 2025 | Friday, April eleventh, 2025 |

| 8 | Sunday, April thirteenth, 2025 | Saturday, April twenty sixth, 2025 | Friday, April twenty fifth, 2025 |

| 9 | Sunday, April twenty seventh, 2025 | Saturday, Might tenth, 2025 | Friday, Might ninth, 2025 |

| 10 | Sunday, Might eleventh, 2025 | Saturday, Might twenty fourth, 2025 | Friday, Might twenty third, 2025 |

| 11 | Sunday, Might twenty fifth, 2025 | Saturday, June seventh, 2025 | Friday, June sixth, 2025 |

| 12 | Sunday, June eighth, 2025 | Saturday, June twenty first, 2025 | Friday, June twentieth, 2025 |

| …and so forth… |

(This desk would proceed for all 26 pay intervals of 2025.)

Necessary Issues for Employers:

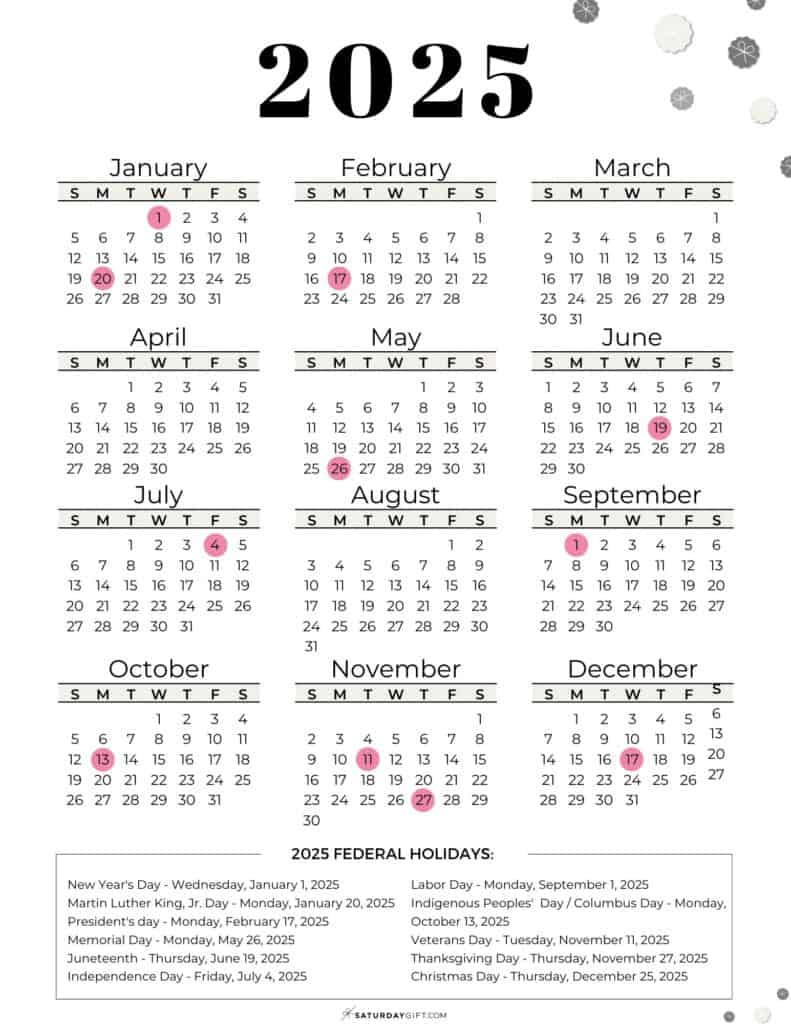

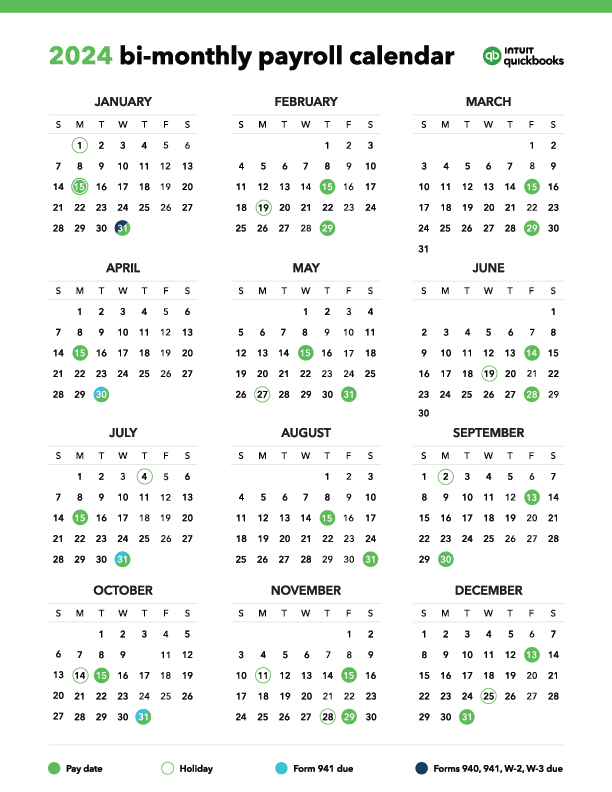

- Vacation Pay: The 2025 calendar consists of a number of holidays. Employers should decide how vacation pay shall be dealt with throughout the bi-weekly schedule. Will staff be paid for holidays even when they don’t seem to be labored? Pays intervals be adjusted? Clear communication is essential.

- Payroll Software program: Using payroll software program is essential for accuracy and effectivity. These packages mechanically calculate wages, deductions, and taxes, minimizing errors and saving time.

- Compliance: Employers should stay compliant with all federal, state, and native payroll laws. This consists of correct tax withholding, reporting, and well timed fee of payroll taxes.

- Yr-Finish Processing: Cautious planning is critical for year-end payroll duties, together with W-2 preparation and distribution. Start getting ready nicely upfront to make sure a clean transition into the brand new 12 months.

- Communication: Common communication with staff about payroll schedules, pay dates, and any adjustments is crucial for sustaining transparency and belief.

Necessary Issues for Workers:

- Budgeting: The shifting pay dates of a bi-weekly schedule could make budgeting difficult. Workers ought to create a price range that accounts for the fluctuating paydays.

- Direct Deposit: Enrolling in direct deposit ensures well timed and safe fee.

- Payroll Inquiries: If there are any discrepancies or questions on payroll, staff ought to contact their HR or payroll division promptly.

- Understanding Deductions: Workers ought to fastidiously evaluation their pay stubs to grasp all deductions, together with taxes, insurance coverage premiums, and different withholdings.

- Monitoring Paid Time Off: Workers ought to maintain monitor of their paid day off (PTO) accrual and utilization to keep away from any points with pay.

Using On-line Assets and Instruments:

Quite a few on-line assets and instruments can help in creating and managing a bi-weekly payroll calendar. Many payroll software program suppliers provide calendar technology options, whereas on-line calendar purposes will be custom-made to replicate particular pay intervals. Nonetheless, at all times double-check the generated calendar in opposition to official vacation dates and firm coverage.

Conclusion:

The 2025 bi-weekly payroll calendar requires cautious planning and execution. By understanding the intricacies of the bi-weekly cycle, using applicable instruments, and sustaining open communication, each employers and staff can navigate the 12 months easily. Keep in mind that this text supplies a pattern calendar; your particular payroll schedule shall be decided by your employer’s insurance policies. All the time discuss with your organization’s official payroll calendar and make contact with your HR or payroll division for any questions or clarifications. Proactive planning and a spotlight to element will contribute to a profitable and stress-free payroll course of all through 2025. Keep in mind to seek the advice of with payroll professionals or authorized counsel to make sure full compliance with all relevant laws.

Closure

Thus, we hope this text has supplied invaluable insights into Navigating the 2025 Bi-Weekly Payroll Calendar: A Complete Information for Employers and Workers. We thanks for taking the time to learn this text. See you in our subsequent article!