Mastering Your 2025 Bi-Weekly Payroll: A Complete Information to Excel Templates and Greatest Practices

Associated Articles: Mastering Your 2025 Bi-Weekly Payroll: A Complete Information to Excel Templates and Greatest Practices

Introduction

On this auspicious event, we’re delighted to delve into the intriguing subject associated to Mastering Your 2025 Bi-Weekly Payroll: A Complete Information to Excel Templates and Greatest Practices. Let’s weave attention-grabbing info and provide contemporary views to the readers.

Desk of Content material

Mastering Your 2025 Bi-Weekly Payroll: A Complete Information to Excel Templates and Greatest Practices

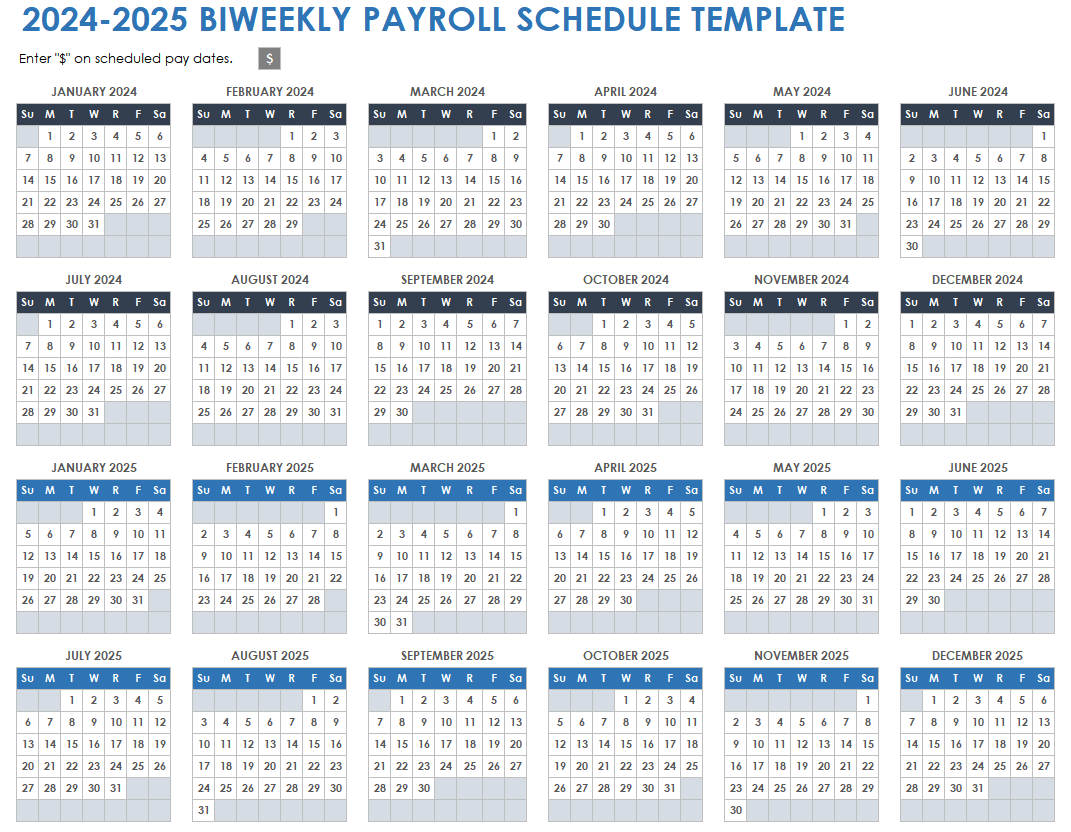

The 12 months 2025 is quick approaching, and with it comes the necessity for environment friendly payroll administration. For companies counting on a bi-weekly payroll schedule, having a well-organized and correct system is paramount. This text dives deep into the creation and utilization of a 2025 bi-weekly payroll calendar template in Excel, providing a complete information overlaying template design, important options, greatest practices, and potential pitfalls to keep away from.

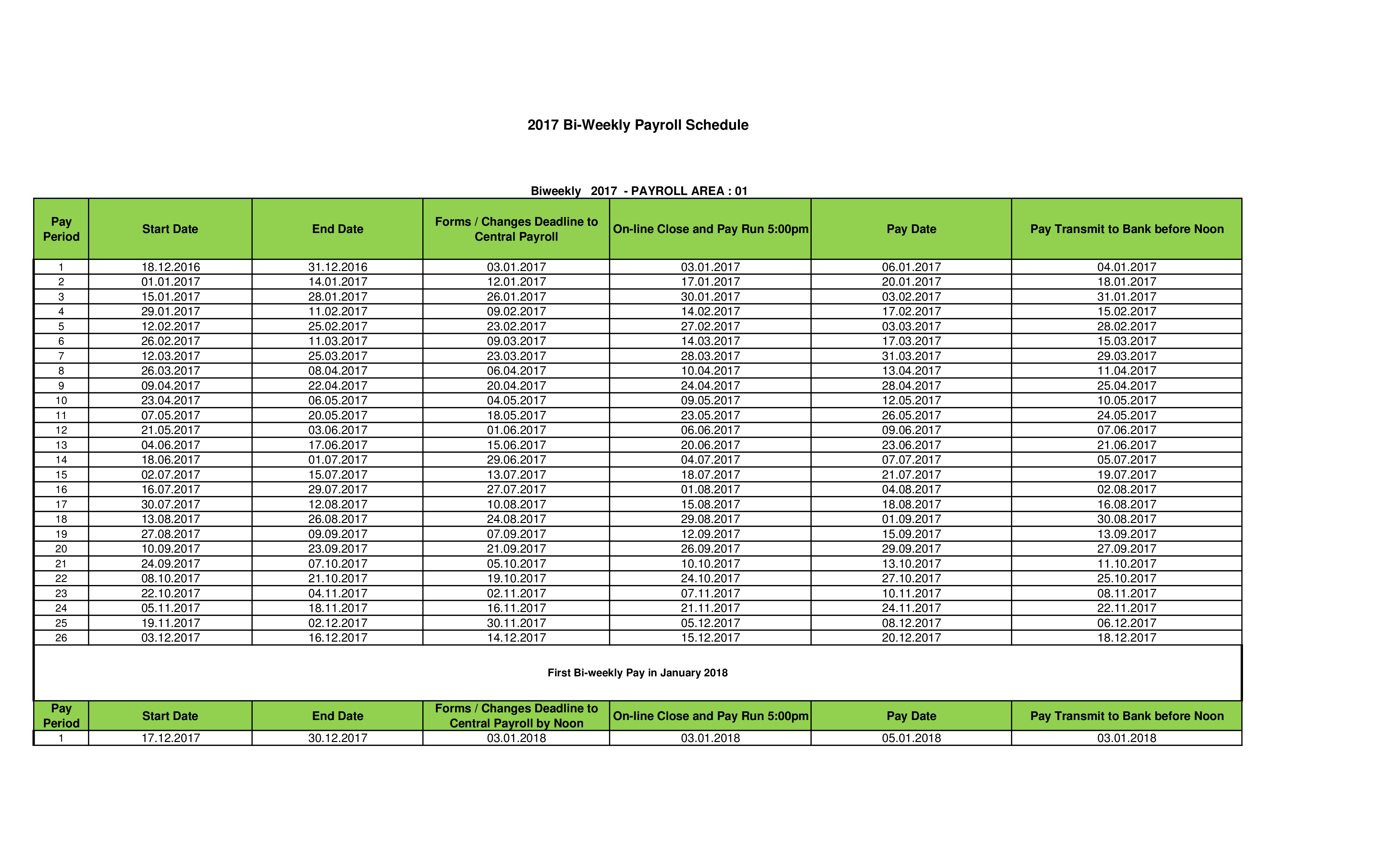

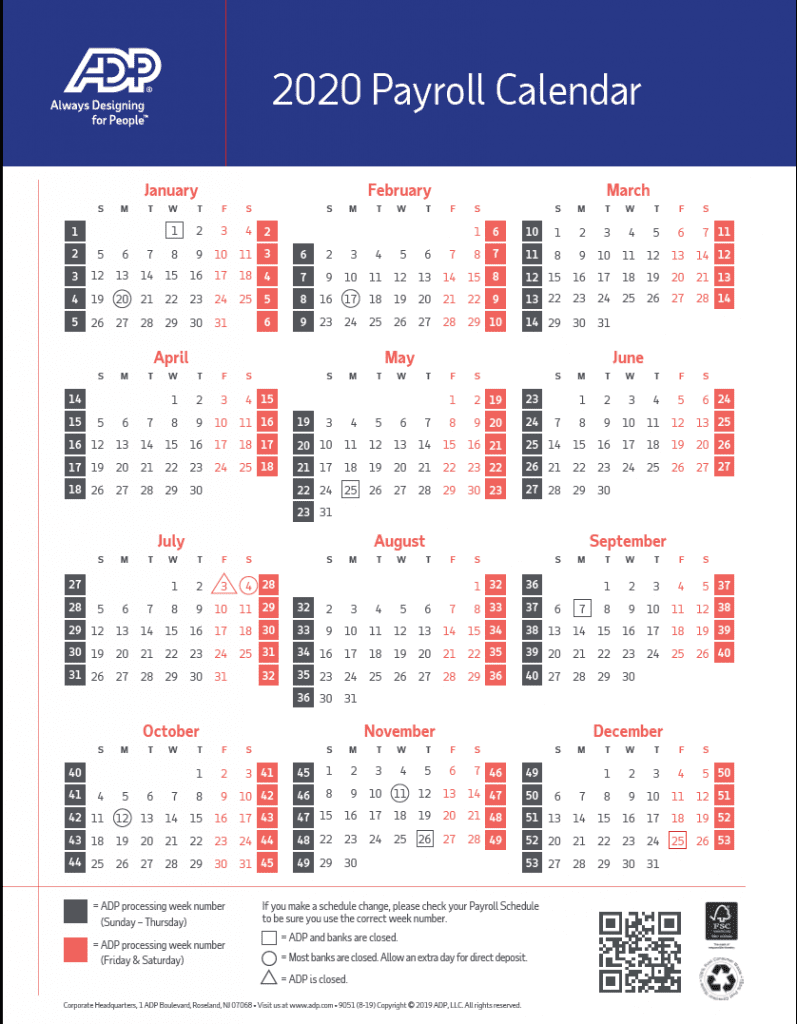

Understanding the Bi-Weekly Payroll Cycle:

Earlier than delving into the Excel template, understanding the nuances of a bi-weekly payroll cycle is essential. A bi-weekly payroll means workers are paid each two weeks, leading to 26 pay durations per 12 months. This differs from semi-monthly payroll (twice a month), which generally entails 24 pay durations. The various variety of days in every month and the potential for holidays considerably affect the exact dates of every pay interval. A well-designed 2025 bi-weekly payroll calendar template in Excel accounts for these variations, guaranteeing accuracy and stopping potential discrepancies.

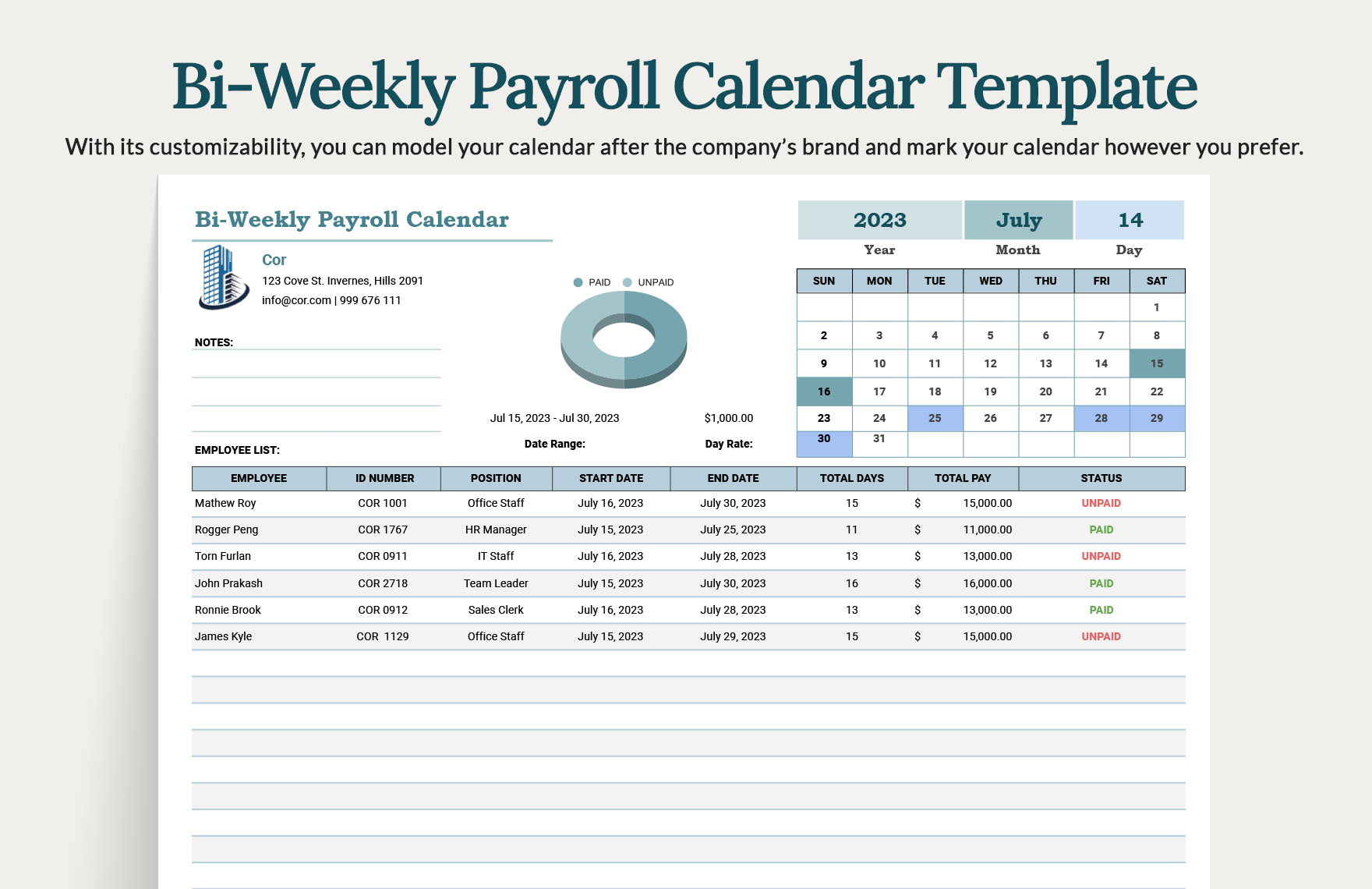

Creating Your 2025 Bi-Weekly Payroll Calendar in Excel:

The muse of environment friendly payroll administration lies in a well-structured Excel template. This is a step-by-step information to constructing your 2025 bi-weekly payroll calendar:

-

Establishing the Calendar: Start by making a desk with columns for:

- Pay Interval: Numbering every bi-weekly interval (1-26).

- Pay Interval Begin Date: The date the pay interval begins.

- Pay Interval Finish Date: The date the pay interval ends.

- Pay Date: The date workers obtain their cost.

- Days in Pay Interval: The variety of days inside every pay interval.

- Notes: Area for recording any related info (e.g., holidays falling inside the pay interval).

-

Getting into the Dates: Manually enter the beginning date of your first pay interval in 2025. That is your anchor level. Subsequent begin dates could be calculated utilizing formulation. For instance, in case your first pay interval begins on January sixth, 2025, the subsequent pay interval begins 14 days later (January twentieth). Excel’s

DATEoperate and relative cell referencing can automate this course of. -

Formulation for Automation: Leverage Excel’s energy to automate calculations. Use formulation to calculate:

-

Finish Date:

=A2+13(assuming the beginning date is in cell A2 and pay durations are 14 days). Regulate the+13to accommodate variations in case your pay durations do not at all times finish on the 14th day. -

Pay Date: This could be a fastened variety of days after the tip date (e.g., two days later). Use a components like

=B2+2(assuming the tip date is in cell B2). Regulate this based mostly in your firm’s cost schedule. -

Days in Pay Interval: Use the

DAYSoperate:=DAYS(B2,A2)+1(calculating the variety of days between begin and finish dates, inclusive).

-

Finish Date:

-

Dealing with Holidays and Weekends: Manually modify the dates if holidays fall inside a pay interval. Contemplate including a column to point holidays and their affect on pay calculations. You may want to regulate the pay interval finish date or the pay date to account for these non-working days.

-

Knowledge Validation: Implement information validation to forestall errors. As an example, guarantee dates are entered appropriately and that pay durations are sequentially numbered.

-

Formatting and Presentation: Format the calendar for readability and readability. Use conditional formatting to focus on holidays or necessary dates. Think about using totally different colours for weekends and weekdays.

Important Options to Embody in Your Template:

Past the fundamental calendar, incorporating further options enhances the template’s performance:

- Worker Data: Hyperlink the calendar to a separate sheet containing worker particulars (identify, ID, pay fee, and so on.). This enables for automated payroll calculations.

- Tax Data: Embody columns for related tax deductions (federal, state, native). Use formulation to routinely calculate these deductions based mostly on worker earnings and tax charges.

- Deductions and Advantages: Add sections for different deductions (medical health insurance, retirement contributions) and advantages (bonuses, time beyond regulation pay).

- Gross and Web Pay Calculation: Implement formulation to calculate gross pay (complete earnings earlier than deductions) and internet pay (quantity obtained after deductions).

- 12 months-to-Date (YTD) Totals: Observe YTD earnings, deductions, and taxes for every worker. That is essential for correct year-end reporting and tax filings.

- Reporting Options: Embody options to generate experiences summarizing payroll information for various durations (month-to-month, quarterly, yearly). This might contain utilizing pivot tables or creating separate abstract sheets.

Greatest Practices for Utilizing Your Excel Payroll Template:

- Common Backups: Often again up your Excel file to forestall information loss.

- Knowledge Safety: Shield your spreadsheet with passwords to safeguard delicate worker info.

- Model Management: Keep totally different variations of the template for various years.

- Accuracy Checks: Often overview and audit the information to make sure accuracy. Cross-check calculations and evaluate in opposition to earlier pay durations.

- Coaching and Documentation: Present sufficient coaching to workers accountable for utilizing the template. Create clear documentation explaining its options and the best way to use it appropriately.

- Compliance: Guarantee your payroll practices and template adjust to all related federal, state, and native laws.

Potential Pitfalls to Keep away from:

- Guide Knowledge Entry Errors: Decrease guide information entry to scale back errors. Automate as a lot as attainable utilizing formulation and information validation.

- Inconsistent Formatting: Keep constant formatting all through the template for readability and accuracy.

- Outdated Tax Data: Often replace tax charges and deduction info to make sure compliance.

- Lack of Audit Path: Keep an audit path of all modifications made to the spreadsheet.

- Ignoring Holidays: Failing to account for holidays can result in inaccurate pay calculations.

Conclusion:

A well-designed 2025 bi-weekly payroll calendar template in Excel is a cornerstone of environment friendly payroll administration. By following the rules outlined on this article, companies can create a strong and dependable system that minimizes errors, saves time, and ensures compliance. Bear in mind to prioritize accuracy, safety, and common updates to take care of the integrity of your payroll information. The funding in making a complete and well-maintained Excel template can pay dividends when it comes to accuracy, effectivity, and peace of thoughts. Contemplate consulting with a payroll skilled or accountant to make sure your template aligns with all authorized and regulatory necessities.

Closure

Thus, we hope this text has supplied worthwhile insights into Mastering Your 2025 Bi-Weekly Payroll: A Complete Information to Excel Templates and Greatest Practices. We admire your consideration to our article. See you in our subsequent article!