Mastering the Amex Platinum Lodge Credit score: A Complete Information to Maximizing Your $200 Profit

Associated Articles: Mastering the Amex Platinum Lodge Credit score: A Complete Information to Maximizing Your $200 Profit

Introduction

With enthusiasm, let’s navigate via the intriguing matter associated to Mastering the Amex Platinum Lodge Credit score: A Complete Information to Maximizing Your $200 Profit. Let’s weave attention-grabbing data and provide recent views to the readers.

Desk of Content material

Mastering the Amex Platinum Lodge Credit score: A Complete Information to Maximizing Your $200 Profit

The American Categorical Platinum card is famend for its spectacular suite of advantages, and among the many most dear is the annual $200 resort credit score. This credit score, utilized towards eligible bookings made via Amex Nice Accommodations + Resorts (FHR) or The Lodge Assortment (THC), can considerably cut back the price of your luxurious resort stays. Nevertheless, maximizing this profit requires understanding its intricacies and strategic planning. This text offers a complete information to navigating the Amex Platinum resort credit score, serving to you unlock its full potential all through the calendar 12 months.

Understanding the Mechanics of the $200 Lodge Credit score:

The $200 resort credit score is issued yearly, resetting in your card’s anniversary date. This implies you’ve gotten a full 12 months to make the most of the credit score. Crucially, it is a assertion credit score, that means it is utilized after your keep, lowering the ultimate cost in your assertion. It isn’t a reduction utilized on the time of reserving.

Key Issues:

-

Eligible Bookings: The credit score is simply relevant to bookings made via both Amex Nice Accommodations + Resorts (FHR) or The Lodge Assortment (THC). Reserving straight with the resort or via different third-party platforms will not qualify.

-

Reserving Channels: You will need to e book your keep via the Amex Journey portal, which may be accessed via your Amex account on-line or through the Amex app.

-

Eligible Bills: The credit score applies to the room fee and sure eligible incidental prices, however not all. Usually, taxes and resort charges are included, however different extras like spa remedies or eating are sometimes excluded. All the time examine your ultimate assertion to verify the credit score utility.

-

A number of Bookings: You need to use the credit score on a number of bookings all year long, supplied the overall worth of eligible bills does not exceed $200.

-

No Carryover: Any unused portion of the $200 credit score expires on the finish of your card membership 12 months. Do not let it go to waste!

Amex Nice Accommodations + Resorts (FHR) vs. The Lodge Assortment (THC):

Whereas each provide advantages along with your Platinum card, there are key variations:

-

Amex Nice Accommodations + Resorts (FHR): FHR presents a extra luxurious expertise, sometimes with higher-end inns and resorts. Advantages usually embrace:

- Room improve upon arrival (topic to availability)

- Each day breakfast for 2

- Assured 4 PM late checkout

- Particular amenity (e.g., spa credit score, complimentary drinks)

- Complimentary Wi-Fi

-

The Lodge Assortment (THC): THC offers a extra budget-friendly choice, that includes a wider vary of inns, although nonetheless inside a good choice. Advantages often embrace:

- Room improve upon arrival (topic to availability)

- Each day breakfast for 2

- Assured midday late checkout

- Particular amenity (e.g., complimentary drinks, meals and beverage credit score)

- Complimentary Wi-Fi

Selecting between FHR and THC is determined by your finances and desired degree of luxurious. FHR usually presents a greater worth proposition should you’re looking for a premium expertise, contemplating the included facilities. Nevertheless, THC generally is a nice choice for maximizing your $200 credit score on extra inexpensive stays.

Strategic Planning for Maximizing Your Credit score:

To take advantage of your $200 resort credit score, take into account these methods:

-

Plan Forward: Do not wait till the tip of your card membership 12 months to e book. Fashionable inns and dates e book up shortly, particularly throughout peak seasons. Begin planning your journeys early.

-

Think about Off-Season Journey: Lodge charges are sometimes decrease through the low season, permitting you to stretch your $200 credit score additional. You’ll be able to doubtlessly get extra worth by reserving an extended keep or a higher-priced room inside your finances.

-

Bundle Your Journeys: When you’ve got a number of journeys deliberate all year long, strategically e book them via FHR or THC to maximise your credit score utilization.

-

Monitor Your Assertion: All the time examine your assertion after every keep to make sure the credit score has been utilized accurately. If there’s a difficulty, contact Amex customer support instantly.

-

Consider Taxes and Charges: Keep in mind that taxes and resort charges are sometimes included within the eligible bills. Nevertheless, be aware of different prices that may not be lined.

-

Discover Totally different Locations: Do not restrict your self to acquainted locations. Discover new areas and make the most of doubtlessly decrease resort charges in lesser-known areas.

-

Make the most of the Amex Journey Portal: The Amex Journey portal presents glorious search capabilities, permitting you to simply examine inns and filter based mostly in your preferences and finances.

-

Learn the Nice Print: Earlier than reserving, rigorously assessment the phrases and circumstances of FHR and THC to know the particular advantages and eligibility necessities.

Superior Methods for Skilled Customers:

-

Mix with Different Amex Advantages: Think about using your Amex Platinum card’s different advantages, corresponding to airport lounge entry or International Entry/TSA PreCheck credit, to additional improve your journey expertise.

-

Leverage Factors and Miles: If you happen to’re a frequent traveler, take into account transferring factors or miles from different loyalty packages to e book your keep, doubtlessly additional lowering the associated fee.

-

Observe Your Spending: Preserve a file of your bookings and assertion credit to make sure you’re taking advantage of your annual profit.

Conclusion:

The Amex Platinum card’s $200 resort credit score is a beneficial perk that may considerably cut back the price of your resort stays. By understanding this system’s mechanics, strategically planning your bookings, and using the ideas outlined on this information, you’ll be able to maximize this profit and luxuriate in luxurious lodging with out breaking the financial institution. Keep in mind, the important thing to success is proactive planning and cautious consideration to element. Do not let this beneficial credit score go to waste – begin planning your dream getaways right this moment! The $200 credit score is ready for use, and with somewhat planning, it will possibly make a big distinction in your journey finances all through the calendar 12 months. Keep in mind to examine the Amex web site for essentially the most up-to-date phrases and circumstances earlier than reserving your keep.

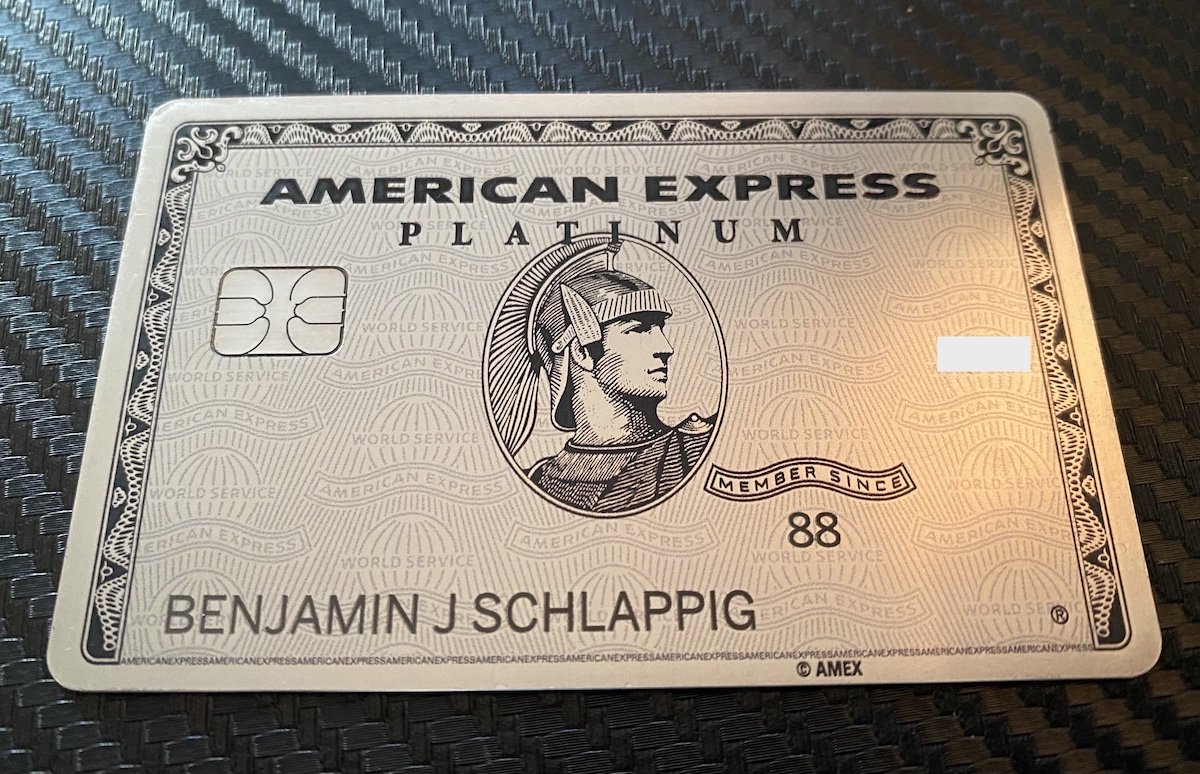

![How To Upgrade or Downgrade the Amex Platinum [2024]](https://upgradedpoints.com/wp-content/uploads/2022/09/Amex-Platinum-Upgraded-Points-LLC-12-Large.jpg)

![]()

Closure

Thus, we hope this text has supplied beneficial insights into Mastering the Amex Platinum Lodge Credit score: A Complete Information to Maximizing Your $200 Profit. We recognize your consideration to our article. See you in our subsequent article!