Decoding the Virginia State Worker Pay Calendar: A Complete Information

Associated Articles: Decoding the Virginia State Worker Pay Calendar: A Complete Information

Introduction

With nice pleasure, we are going to discover the intriguing matter associated to Decoding the Virginia State Worker Pay Calendar: A Complete Information. Let’s weave attention-grabbing data and provide contemporary views to the readers.

Desk of Content material

Decoding the Virginia State Worker Pay Calendar: A Complete Information

Navigating the complexities of a state authorities’s payroll system might be daunting, particularly for brand spanking new staff. Understanding your pay schedule is essential for budgeting, monetary planning, and total job satisfaction. This text supplies an in depth overview of the Virginia state worker pay calendar, addressing widespread questions and providing sensible suggestions for managing your funds successfully.

Understanding the Bi-Weekly Pay Cycle:

Virginia state staff are usually paid bi-weekly, which means they obtain their paychecks twice a month. This differs from different cost frequencies like month-to-month or semi-monthly. The precise dates of those paydays are usually not mounted and fluctuate all year long, influenced by weekends and holidays. This variability could make it difficult to foretell pay dates with out entry to an official calendar.

Accessing the Official Pay Calendar:

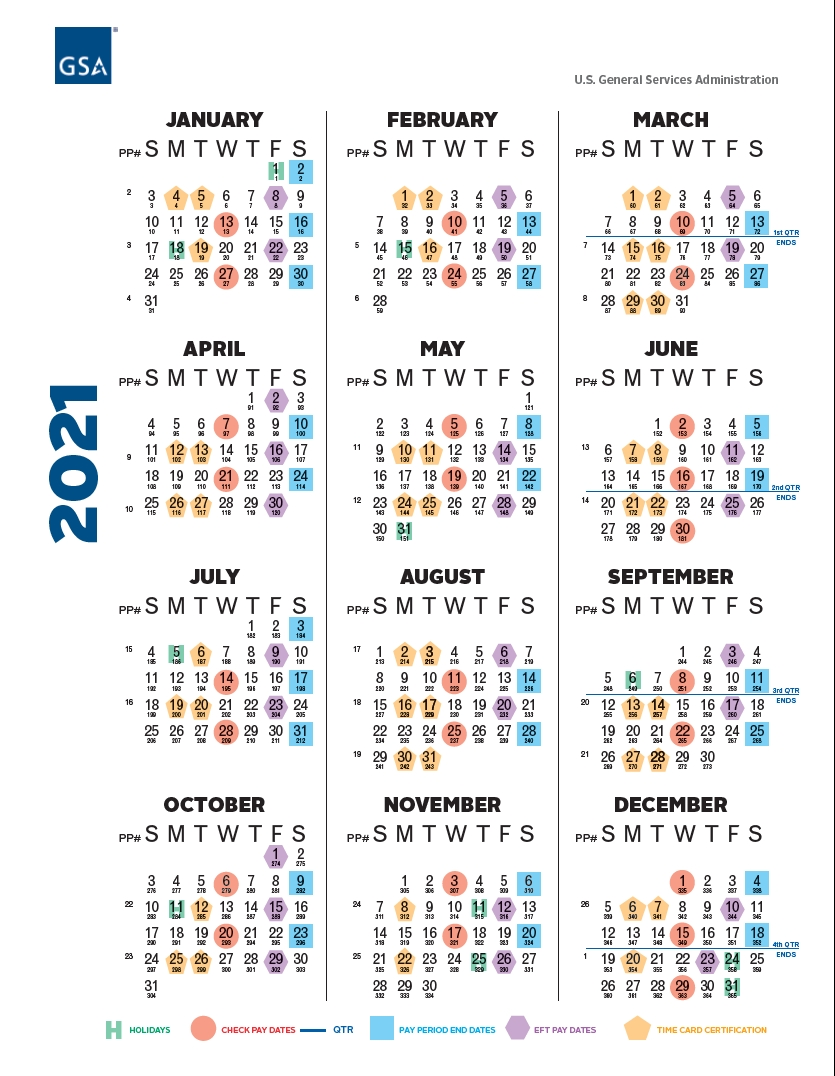

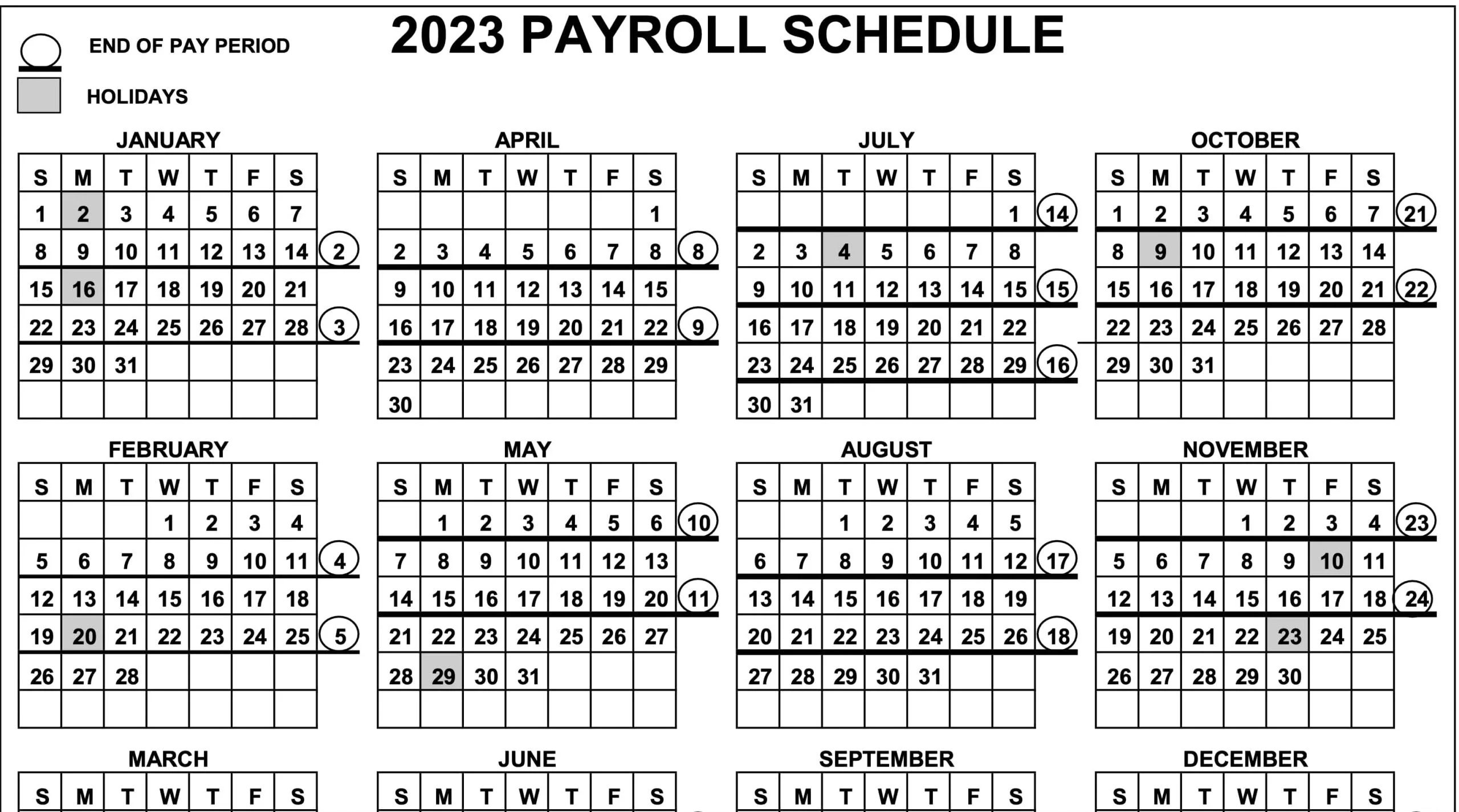

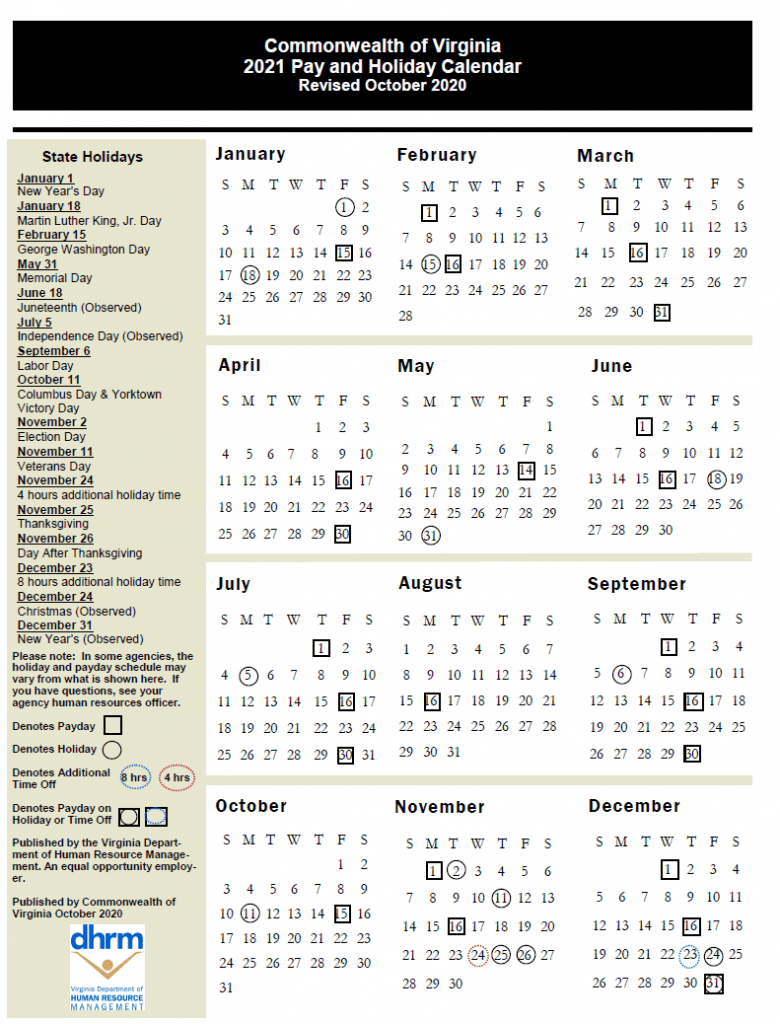

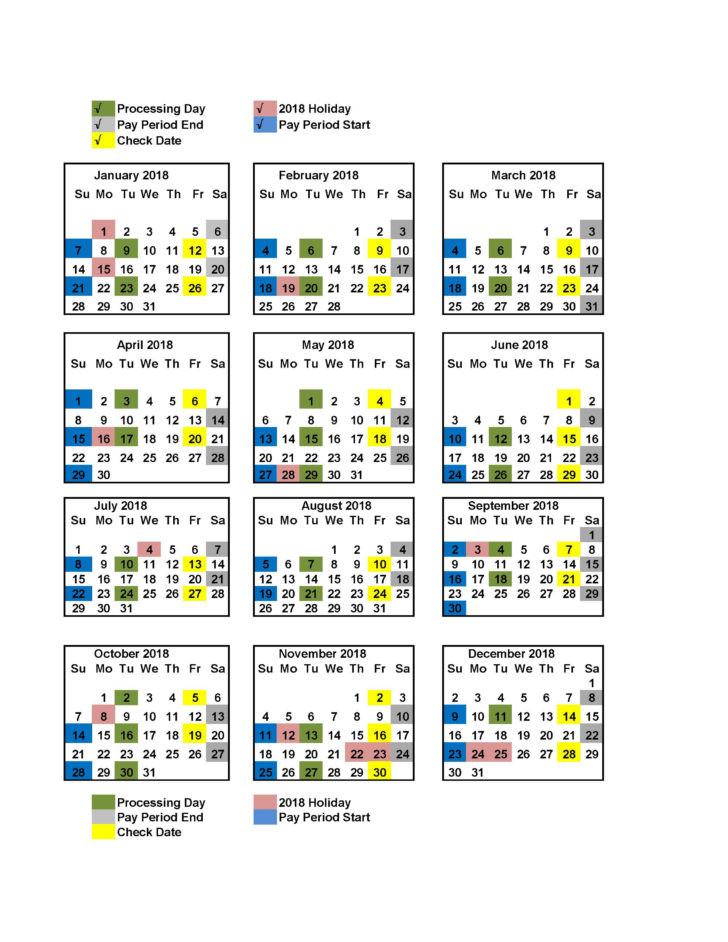

Probably the most dependable supply for the Virginia state worker pay calendar is the official web site of the Division of Human Useful resource Administration (DHRM). This web site normally supplies a downloadable calendar or a schedule clearly outlining the pay dates for your complete fiscal yr. The calendar usually contains:

- Pay Interval Dates: The beginning and finish dates of every pay interval. Understanding these dates is important for precisely monitoring your hours labored and making certain right cost.

- Payday Dates: The particular dates when your paycheck will probably be deposited or out there for assortment. These dates are essential for budgeting and monetary planning.

- Holidays: State holidays that will have an effect on pay intervals and payday dates. Understanding how holidays influence the pay schedule helps keep away from any surprises or delays in cost.

It’s essential to examine the DHRM web site commonly, as updates could also be issued all year long. Counting on unofficial sources or outdated data may result in inaccurate predictions and potential monetary issues.

Components Influencing Pay Dates:

A number of components contribute to the variability of Virginia state worker pay dates:

- Weekends: Paydays are usually adjusted to keep away from falling on weekends. If a payday falls on a Saturday or Sunday, it should doubtless be shifted to the previous Friday.

- Holidays: State and federal holidays considerably affect the pay calendar. If a payday falls on a vacation, it should normally be moved to the previous workday.

- Fiscal Yr: The Virginia state authorities operates on a fiscal yr, usually operating from July 1st to June thirtieth. The pay calendar aligns with this fiscal yr, which means the pay schedule typically resets at the start of every fiscal yr.

- System Updates: Often, technical points or system updates throughout the DHRM’s payroll system might trigger minor delays in payday. These delays are normally communicated effectively prematurely.

Navigating Payroll Deductions:

Understanding payroll deductions is simply as necessary as understanding the pay calendar itself. Virginia state staff can have numerous deductions utilized to their gross pay, together with:

- Federal Earnings Tax: Tax withheld primarily based in your W-4 type.

- State Earnings Tax: Tax withheld primarily based in your Virginia state tax withholding data.

- Social Safety Tax (FICA): A contribution in direction of Social Safety advantages.

- Medicare Tax (FICA): A contribution in direction of Medicare advantages.

- Retirement Contributions: Contributions to the Virginia Retirement System (VRS) or different retirement plans.

- Well being Insurance coverage Premiums: Deductions for medical insurance protection.

- Different Deductions: These might embody union dues, charitable contributions, or different deductions licensed by the worker.

Frequently reviewing your pay stub is important to make sure the accuracy of those deductions. Any discrepancies ought to be reported to the DHRM promptly.

Managing Your Funds Successfully:

Predictable revenue is important for efficient monetary administration. Whereas the bi-weekly pay cycle provides constant revenue, the fluctuating pay dates can pose challenges. Listed below are some methods that can assist you handle your funds successfully:

- Budgeting: Create an in depth price range that accounts to your bi-weekly revenue and bills. This may assist you to observe your spending and make sure you manage to pay for to cowl your payments.

- Payday Reminders: Set reminders in your calendar or use budgeting apps to be alerted when your payday is approaching.

- Direct Deposit: Make the most of direct deposit to make sure your paycheck is routinely deposited into your checking account on the payday, eliminating the necessity for guide assortment.

- Emergency Fund: Construct an emergency fund to cowl sudden bills or delays in cost.

- Monetary Planning: Develop a long-term monetary plan that accounts to your bi-weekly revenue and your monetary targets.

Addressing Frequent Issues:

- Missed Paychecks: Should you miss a paycheck, contact the DHRM instantly to analyze the difficulty. They may help in figuring out the reason for the delay and resolving the matter.

- Incorrect Pay Quantities: In case your paycheck is inaccurate, fastidiously evaluation your pay stub and evaluate it to your hours labored and deductions. Contact the DHRM in case you discover any discrepancies.

- Modifications in Private Info: Notify the DHRM promptly of any adjustments to your private data, akin to handle, banking particulars, or tax standing. This ensures your paycheck is processed precisely and delivered to the right location.

Conclusion:

The Virginia state worker pay calendar, whereas seemingly advanced at first, turns into manageable with understanding and proactive planning. By accessing the official DHRM sources, understanding the components influencing pay dates, and implementing efficient monetary administration methods, state staff can confidently navigate their payroll system and preserve sound monetary well being. Do not forget that proactive communication with the DHRM is vital to resolving any points or questions that will come up. Frequently checking the official web site and reviewing your pay stubs are essential steps in making certain correct and well timed funds.

Closure

Thus, we hope this text has offered priceless insights into Decoding the Virginia State Worker Pay Calendar: A Complete Information. We admire your consideration to our article. See you in our subsequent article!